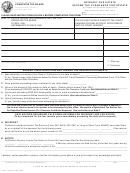

Form Rev-181-I - Instructions For Securing A Tax Clearance Certificate To File With The Pa Department Of State Page 2

ADVERTISEMENT

2.

When a qualified foreign association files an application for termination of authority or sim-

ilar document; and

3.

When a domestic association files articles or a certificate of division dividing solely into non-

qualified foreign associations.

Tax Clearance Certificates in Judicial Proceedings

Until a Tax Clearance Certificate from the Department of Revenue and the Department of Labor and

Industry has been filed with the court, the court cannot order the dissolution of a domestic business

corporation, nonprofit corporation or business trust. Nor can it approve a final distribution of the

assets of a domestic general partnership, limited partnership, electing partnership or limited liability

company.

To file a tax clearance certificate and accompanying documents with the Department of State, send

documents and a $70 check made payable to the PA Department of State to the following address:

PA DEPARTMENT OF STATE

CORPORATION BUREAU

NORTH OFFICE BUILDING ROOM 308

PO BOX 8722

HARRISBURG PA 17105-8722

For Revenue forms, visit or call (717) 783-6052.

For information from the Department of State, visit or call

(717) 787-1057.

The Fiscal Code governing tax clearance certificates may be viewed online at

under “Legal/Legislative Information.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2