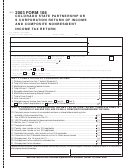

2012 M8A

Apportionment and Minimum Fee 2012

B

B

B

Place an X in the box if you conduct all activity

1

2

3

in Minnesota, and enter 1.00000 on line 18.

QSSS designated filer

S corporation name

If you’re a qualified business participating in a JOBZ

FEIN

zone in Minnesota and all your property and payroll

Minnesota tax ID

are within the zone, you are exempt from the mini-

mum fee. Enter zero on line 21 below and on line 2

A

of Form M8.

Total In and

Outside Minnesota

In Minnesota

In Minnesota

In Minnesota

1

1 Average inventory . . . . . . . . . . . . . .

2 Average tangible property

2

(at original cost) . . . . . . . . . . . . . . . .

3 Average land owned/used

3

(at original cost) . . . . . . . . . . . . . . . .

4

Financial institutions only: average

4

intangible property (see inst., pg. 8) . . .

5

5 Capitalized rents (gross rents x 8) .

6 Total property (add lines 1 – 5;

6

if Col. A is zero, see inst., pg. 7) . . .

7 Minnesota property factor (divide each

7

line 6B amount by line 6A; carry to five decimal places) . . . . . . . .

8

0 .035

0 .035

0 .035

8 Property factor weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Weighted ratio for PROPERTY (multiply line 7 by line 8) . . . . . . . .

10 Payroll/officer’s compensation

10

(if Col. A is zero, see inst., pg. 7) . . .

11 Minnesota payroll factor (divide each

11

line 10B amount by line 10A; carry to five decimal places) . . . . . .

12

0 .035

0 .035

0 .035

12 Payroll factor weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Weighted ratio for PAYROLL (multiply line 11 by line 12) . . . . . . .

13

14 Sales or receipts (if a financial

institution or if Col. A is zero,

14

see inst., pg. 7) . . . . . . . . . . . . . . . . .

15 Minnesota sales factor (divide each

15

line 14B amount by line 14A; carry to five decimal places) . . . . . .

0 .93

0 .93

0 .93

16

16 Sales factor weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17 Weighted ratio for SALES (multiply line 15 by line 16) . . . . . . . . . .

18 APPORTIONMENT FACTOR

(Add lines 9, 13 and 17 in each column OR if you conduct all

18

activity in Minnesota, enter 1.00000 on line 18) . . . . . . . . . . . . . .

Minimum fee calculation (read instructions, pg. 9)

19

19 Adjustments (see instructions, pg. 9) . . . . . . . . . . . . . . . . . . . . . . .

20

20 Add lines 6, 10, 14 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

21 Minimum fee (see table below) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add line 21 amounts and enter on Form M8, line 2.

If the amount

Enter this amount

If the amount

Enter this amount

on line 20 is:

on line 21:

on line 20 is:

on line 21:

less than $500,000 . . . . . . . . . . . . . . . . . $0

$5,000,000 to $9,999,999 . . . . . . . . . . . . . $1,000

$500,000 to $999,999 . . . . . . . . . . . . . $100

$10,000,000 to $19,999,999 . . . . . . . . . . . $2,000

$1,000,000 to $4,999,999 . . . . . . . . . . $300

$20,000,000 or more . . . . . . . . . . . . . . . . . . $5,000

1

1 2

2