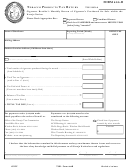

Instructions for Completing Forms 4096A,

Michigan Tobacco Products Tax Return

This form is provided to report and pay the applicable Michigan tobacco taxes on purchases of cigarettes and Other Tobacco

Products (OTP) by Michigan residents from the Internet or Mail Order providers. OTP includes cigars, chewing tobacco, pipe

tobacco, loose tobacco (roll your own) and snuff. Please refer to the Consumer Warning on page 2 of these instructions.

The reporting form is separated into four parts:

(1) The first three parts are used to report cigarettes by various packaging configurations of 20-Cigarette Packs, 25-Cigarette

Packs, and Other Quantities of Cigarettes (packs that contain less than 20 cigarettes are reported by per cigarette.)

(2) The fourth part is to report Other Tobacco Products.

Use Form 4096B to report cigarettes and OTP purchased after June 30, 2004. The different forms

reflect the tobacco tax rates in effect at the time of purchase.

Tax Rates: August 1, 2002 through June 30, 2004:

Cigarettes are taxed at the rate of 6 ¼ cents (.0625) per cigarette

$1.25 per pack of 20 cigarettes (20 cigarettes x .0625 = $1.25)

$1.5625 per pack of 25 cigarettes (25 cigarettes x .0625 = $1.5625)

OTP is taxed at 20% of the wholesale price. (See Note 1)

Note 1: Determine wholesale price for OTP by multiplying the retail price paid for the OTP (less

shipping and handling) by 50%. Example: Taxpayer A pays $20.00 (retail) for chewing

tobacco. Wholesale price is $10.00 ($20.00 x 50%).

Use Tax

Michigan Use Tax is also due on tobacco products purchased from Internet or Mail Order vendors. Use tax is calculated at 6%

(.06) of the total purchase price, including shipping and handling. The use tax is to be reported on the taxpayer’s annual Individual

Income Tax Return (MI-1040).

Remittance

Make your check payable to the “State of Michigan”. Forward your completed return with payment to the Discovery and Tax

Enforcement Division, at the address identified on the form.

Form 4096A Line-by-Line Instructions:

Enter purchaser’s name, address, city, state, zip and social security number on the lines provided.

Part 1 - 20-Cigarette Packs

Column A – Enter date of purchase.

Column B – Enter name of the tobacco vendor.

Column C – Convert cartons to packs and enter total packs. A carton of 20-Cigarette Pack contains 10 packs of cigarettes.

Column D – Multiply Column C times the tax rate ($1.25 per pack) and enter total.

Part 2 - 25 – Cigarette Packs

Column A – Enter date of purchase.

Column B – Enter name of the tobacco vendor.

Column C – Convert cartons to packs and enter total packs. A carton of 25-Cigarette Pack contains 10 packs of cigarettes.

Column D – Multiply Column C times the tax rate ($1.5625 per pack) and enter total.

Part 3 - Other Quantities of Cigarettes

Column A – Enter date of purchase.

Column B – Enter name of the tobacco vendor.

Column C – Convert packs with less than 20 cigarettes to individual cigarettes and enter total cigarettes.

Column D – Multiply Column C times the tax rate ($.0625 per cigarette) and enter total.

Part 4 – OTP

Column A – Enter date of purchase.

Column B – Enter name of the tobacco vendor.

Column C – Multiply the retail price of the OTP (less shipping and handling) by 50% (to determine the approximate wholesale

price) and enter total.

1

1 2

2 3

3