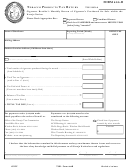

Column D – Multiply Column C times the tax rate (20%) and enter total.

Example:

Taxpayer A purchased the following tobacco products from Company A on June 7, 2004:

15 cartons of 20-cigarette pack at $25.00 per carton ................................................................................... $375.00

5 cartons of 25-cigarette pack at $27.00 per carton ..................................................................................... $135.00

8 packages of exotic cigarettes containing 12 cigarettes per pack at $4.00 per pack .................................... $32.00

4 packages of chewing tobacco at $5.00 per package .................................................................................... $20.00

Total Tobacco Purchase Price ......................................................................................................................... $562.00

Shipping and Handling Fee ............................................................................................................................... $25.00

The total purchase price of tobacco products ............................................................................................... $587.00

The taxpayer will use Form 4096A to compute the tobacco tax as follows:

Column A

Column B

Column C

Column D

Date Acquired

Tobacco Vendor

Amount

Tobacco Tax

Part 1

6/7/2004

Company A

150 packs

$187.50

15 cartons of 20 cigarette packs contains 150 packs (10 packs per carton x 15 cartons)

The tobacco tax on 150 packs x $1.25 = $187.50.

Part 2

6/7/2004

Company A

50 packs

$78.12

5 cartons of 25 pack cigarettes contains 50 packs (10 packs per carton x 5 cartons)

The tobacco tax on 50 packs x $1.5625 = $78.12

Part 3

6/7/2004

Company A

96 cigarettes

$6.00

8 packs containing 12 cigarettes per pack = 96 cigarettes (8 x 12 = 96 cigarettes)

96 cigarettes x .0625 = $6.00

Part 4

6/7/2004

Company A

$10.00

$2.00

4 packages of chewing tobacco purchased for $20.00. The tax is calculated as follows:

$20.00 purchase price x 50% = $10.00. $10.00 x 20% (.20) = $2.00. The total tobacco tax due = $273.62

The total amount of use tax due for this example is determined as follows: Total purchase price of tobacco products $562.00 +

shipping and handling of $25.00 = $587.00 x .06 = $35.22. The use tax is to be reported on the taxpayer’s annual Individual

Income Tax Return (MI-1040), which is due April 15 of the year following the purchase.

Consumer Warning:

It is illegal to purchase tobacco products through the mail or over the Internet without a license

issued by the State of Michigan, unless the vendor is licensed by the State of Michigan and the required tobacco tax is paid by the

vendor. Further, it is illegal for a person not licensed by the State of Michigan to possess cigarettes within Michigan unless each

package of cigarettes has a Michigan Cigarette Stamp on the package. This includes but is not limited to tobacco products

received as a gift or purchased in states outside Michigan, in foreign countries, on United States Military Facilities, or on Native

American Reservations.

The State of Michigan provides this form to assist you in the payment of a required tobacco products tax. Payment of the

required tobacco products tax does not make legal the otherwise illegal possession of the tobacco products. Possession of

unstamped, or otherwise illegal, tobacco products is a crime whether the tax has been paid or not. The possession of any illegal

tobacco product subjects you to a penalty equal to 100 percent of the tobacco tax due and criminal prosecution. Further, the

tobacco products themselves are contraband and subject to seizure.

1

1 2

2 3

3