Withholding Tables For Individual Income Tax - Maine Revenue Services - 2013 Page 8

ADVERTISEMENT

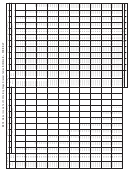

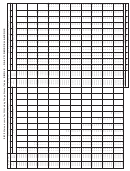

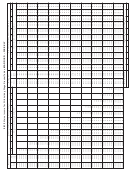

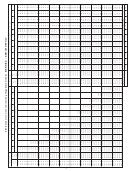

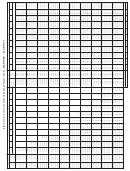

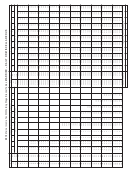

COMMON ITEMS OF INCOME SUBJECT TO WITHHOLDING OF MAINE INCOME TAX

INCOME TYPE

WITHHOLDING REQUIREMENT

WITHHOLDING BASIS

Wage

methods

(wage

Wages — including tips, commissions,

Mandatory

bonuses, severance pay or “golden

bracket tables or permitted

parachute”

payments,

supplemental

alternatives)

unemployment benefi ts (IRC § 3402)

Sick pay paid by employer or employer’s

Mandatory

Wage methods

agent

Third-party sick pay not paid by an

Payee must request

Amount requested by payee

employer or employer’s agent

Periodic

payments

from

employer-

Required, unless payee elects out

Wage methods

sponsored retirement plan (pension,

of withholding

profi t-sharing, stock bonus, etc.) (IRC §

3405)

Lump-sum or other nonperiodic payment

Required, unless payee elects out

Flat 5 percent

from

employer-sponsored

retirement

of federal withholding

plan

Distribution from Individual Retirement

Required, unless payee elects out

Flat 5 percent

Account (IRA) or self-employed pension

of federal withholding

(Keough) plan

Required, unless payee elects out

Private employer-sponsored deferred

Flat 5 percent

of federal withholding

compensation plan (IRC § 401(k))

Distribution from government employer-

Mandatory

Wage methods

sponsored deferred compensation plan

(IRC § 457)

Mandatory

Flat 5 percent

Gambling winnings in excess of $5,000;

lotteries, parimutuel horse and dog races

when odds are at least 300 to 1 (IRC §

3402(q)).

NOTE

: Winnings below these

thresholds are still generally subject to Maine

income tax.

Reportable payments subject to federal

Mandatory

Flat 5 percent

backup withholding when payee fails to

furnish proper Federal Tax Identifi cation

Number, or when payee or payer is

notifi ed by the Internal Revenue Service

that

federal

backup

withholding

is

required (IRC § 3406)

Wages, interest, dividends, rent or other

Mandatory

Flat 5 percent

payments to nonresident aliens of the

United States when federal income tax

withholding is required (IRC § 1441)

Effectively connected income of foreign

Mandatory

Flat 5 percent

partner (IRC § 1446)

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20