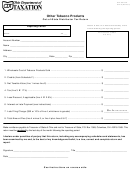

Tobacco Products. Products purchased on or after January 1,

3.

Evidence that the purchaser of the tobacco product did

2012 will be categorized as Tobacco Products (all but Moist Snuff)

not pay the licensee and that the licensee has used

or Moist Snuff.

reasonable collection practices to collect the debt. (Proof

of reasonable collection practices includes copies of

Column K - Number of Ounces: For Moist Snuff purchased on

delinquency letters, invoices showing past due amounts,

or after January 1, 2012 provide the number of ounces of product

and/or copies of US Certifi ed Mail cards showing the

that was deemed to be uncollectible.

person signed for the letter/invoice and /or refused to

accept the letter/invoice.)

Column L - Tax Rate: Provide the tax rate you paid for the

uncollectible product. A table has been provided on the form for

Note: The delivery of tobacco products to a purchaser

your convenience.

who is delinquent on a previous delivery of tobacco

products may result in the department requiring

Column M - Uncollectible Tobacco Products Tax: Multiply the

additional evidence that the licensee used reasonable

wholesale cost or the number of ounces by the appropriate tax

collection practices to collect the debt.

rate and enter the total(s).

4.

Explain why you decide the debt was worthless. For

Total Deduction:

example, you could show that the borrower had declared

Total Bad Debt Deduction: Sum the totals for each category of

bankruptcy, or that legal action to collect would probably

the Uncollectible Tobacco Products Tax Column and enter totals

not result in payment of this debt.

here and on lines 7a & 7b of the monthly return.

5.

A complete copy of the OTP tax returns and details that

pertain to this deduction for the period the tax was paid.

Please note that the following additional information must be

Failure to provide this information if requested could result

available upon request:

in an assessment for the amount of the deduction previously

1.

A copy of the original invoice that supports each of the

received.

bad debts listed above as well as copies of complete

returns with schedules.

2.

Evidence that the tobacco product was delivered to the

purchaser (e.g. a bill of lading signed by the purchaser).

NOTE: If all requested information is not provided for all returns and schedules, your return will be considered as received

incomplete and will result in a reduction of your collection allowance. In addition, you will jeopardize your license status,

including suspension, revocation, or denial of renewal.

1

1 2

2 3

3 4

4