INSTRUCTIONS

WHO MUST FILE. Corporations required to make estimated tax payments must file Corporation Underpayment of Estimated

Tax, Form 2220N, when any underpayment is computed on line 20 of Form 2220N.

Corporations are required to make estimated tax payments if they reasonably expect their Nebraska income tax to exceed

their allowable credits by $400 or more. The allowable credits are: the premium tax credit; the Community Development

Assistance Act (CDAA) credit; the Nebraska tax incentive credits (Form 3800N credits); the Beginning Farmer credit; and

the biodiesel tax credit.

If the amount on line 8 is less than $400, do not complete the rest of the form. No penalty is owed.

WHEN AND WHERE TO FILE. This form must be attached to the

Nebraska Corporation Income Tax Return, Form

1120N,

and filed with that return.

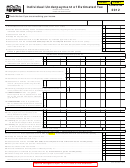

PART I — Calculate the Underpayment

LINE 1. Enter the tax amount from line 13 of the 2012 Form 1120N on line 1 of this form.

LINE 6. The amount entered on this line should only include the Beginning Farmer credit. Any amount claimed for Nebraska

income tax withheld on line 22 of Form 1120N must be included on line 14 of Form 2220N.

LINE 10. The entry on this line allows corporations to use the tax reported on their prior year’s return less the prior year’s

allowable credits to determine whether an underpayment exists. Enter line 18 minus lines 19 and 22 from 2011 Form 1120N

(“Large corporations,” except as noted, cannot use this calculation). The prior year’s Nebraska return must cover a period of

12 months and show a tax liability. If this calculation does not apply, enter the line 9 amount on line 11.

LARGE CORPORATIONS. A “large corporation” is one which had, or its predecessor had, federal taxable income of at

least $1 million for any of the three taxable years immediately preceding the tax year involved. In applying the “$1 million

test,” taxable income is computed without regard to net operating loss and capital loss carrybacks and carryovers.

A large corporation is prohibited from using its prior year’s tax liability, except in determining the first installment of its

tax year. Any reduction in a large corporation’s first installment as a result of using the prior year’s tax must be recaptured

in the corporation’s second installment.

Large corporations compute line 13 amounts by using the same procedures that result in the comparable entry on the Federal

Form 2220.

METHODSTO REDUCE OR AVOID PENALTY. A corporation may reduce or eliminate the penalty by using the annualized

income or adjusted seasonal installment method. To use one or both of these methods to figure one or more required installments,

recalculate and attach the Federal Schedule A, “Adjusted Seasonal Installment Method and Annualized Income Installment

Method” using Nebraska income and other Nebraska amounts.

On this form, enter on line 13 of each column, the corresponding amount from the recalculated Federal Schedule A.

LINE 14. Enter the tax payments made by the corporation and any credit for Nebraska income tax withheld from the

corporation as indicated below.

In Column (A), enter the total of:

1. The corporation’s 2011 overpayment that was credited to its 2012 estimated payments;

2. Any estimated payment made for the 2012 tax year by the date on line 12, Column (A); and

3. Any Nebraska income tax withheld from the corporation by the date on line 12, Column (A).

In Columns (B), (C), and (D), enter the total of:

1. Any estimated payment made for the 2012 tax year by the date on line 12 for that column and after the date on line 12

of the preceding column; and

2. Any Nebraska income tax withheld from the corporation by the date on line 12 for that column and after the date on

line 12 of the preceding column.

LINE 20. UNDERPAYMENT. When an underpayment is reported on this line, complete Part II, lines 22 through 26, to

determine the penalty amount for each underpayment of an installment.

LINE 21. OVERPAYMENT. Any overpayment of an installment on line 21 in excess of all prior underpayments should be

applied as a credit on line 15 against the next installment.

1

1 2

2 3

3