4640, Page 2

Instructions for Form 4640

Conditional Rescission of a Principal Residence Exemption (PRE)

This form enables a person who has established a new principal residence to retain a PRE on property previously exempt as the owner’s

principal residence. The conditional rescission allows an owner to receive a PRE on his or her current Michigan property and on previously

exempted property simultaneously if certain criteria are met. An owner may receive the PRE on the previous principal residence for up to

three years if that property is not occupied, is for sale, is not leased, and is not used for any business or commercial purpose.

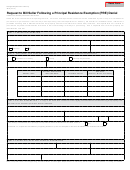

PART 1: CONDITIONAL RESCISSION TYPE

To initially qualify for a conditional rescission, this form must be filed with the assessor for the city or township on or before June 1

(beginning with the summer tax levy) or November 1 (beginning with the winter tax levy) of the first year of the claim. The owner must

annually resubmit this form on or before December 31 to verify to the assessor that the property for which the PRE is retained continues

to meet the conditional requirements listed in the above paragraph. Submit a separate Form 4640 for each exemption being conditionally

rescinded. If the property was receiving a partial exemption, the partial exemption will be maintained during the conditional rescission.

•

Check the “Initial Request” box if this is the first year of the conditional rescission (on or before June 1 or November 1 of the year

of the claim).

•

Check the “Second Year Annual Verification” box if verifying the property still complies with the conditional rescission requirements

for the second year (on or before December 31 of the year prior to the second year).

•

Check the “Third Year Verification” box if verifying the property still complies with the conditional requirements for the third year

(on or before December 31 of the year prior to the third year).

•

Provide the applicable tax year of the conditional rescission.

For example, on October 1, 2012, the initial request for a conditional rescission, check the “Initial Request” box and enter tax year 2012.

In the same example, to retain a PRE for a second year, resubmit this form by December 31, 2012, check the “Second Year Annual

Verification” box, enter tax year 2013, and verify the conditional requirements are met for the second year. You must submit this form

again by December 31, 2013 to retain a PRE for a third year, check “Third Year Annual Verification” box, enter tax year 2014, and verify

the conditional requirements are met for the third year.

If the owner does not annually verify to the assessor, or the assessor finds the property does not meet these conditional requirements, the

assessor shall deny the PRE on that property.

PART 2: PROPERTY INFORMATION

The questions listed in Part 2 are very important in determining eligibility for the conditional rescission. These questions must be

answered truthfully and to the best of the owners’ knowledge. Failure to answer these questions may result in processing delays of the

conditional rescission and/or result in a subsequent denial.

All of the information in Part 2 must be provided to the assessor to process your conditional rescission.

•

Property is identified with a property tax identification number. This number will be found on your tax bill and on your property

tax assessment notice. Enter this number in the space indicated. If you cannot find this number, call your township or city assessor.

Your property number is vital; without it, your township or city cannot adjust your property taxes accurately.

•

Enter the complete property address of the exemption you are rescinding.

•

Enter the name of the township or city in which the property is located and check the appropriate box for city or township. If you

live in a village, list the township in which the property is located.

•

Enter the owner and co-owner’s complete name. Do not include information for a co-owner who did not occupy the property.

•

Enter the Social Security Number(s) of the legal owner(s). The request for the Social Security Number is authorized under section

42 USC 405 (c) (2) (C) (i). It is used by the Department of Treasury to verify tax exemption claims and to deter fraudulent filings.

Any use of the number by closing agents or local units of government is illegal and subject to penalty.

•

Enter the daytime phone number of the owner(s). This number is important because the assessor may need to contact the owner(s)

to verify information in order to process the conditional rescission.

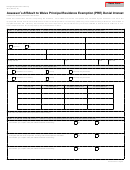

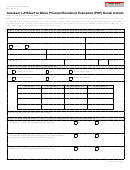

PART 3: CuRRENT PRINCIPAL RESIDENCE

Provide complete information regarding your current principal residence. You must attach a copy of your tax bill and PRE Affidavit for

your current principal residence.

PART 4: OWNER CERTIFICATION

The form must be signed and dated by the owner(s) listed in Part 2. Provide the owner’s current and complete mailing address.

PART 5: ASSESSOR’S CERTIFICATION — LOCAL gOvERNMENT uSE

This form is not valid unless certified by an assessor. The assessor must verify that the conditional rescission complies with the law,

approve or deny the conditional rescission, and attach a copy of the Local Unit Denial (Form 2742), if denying. The assessor also must

provide the year the conditional rescission will be posted to the tax roll.

INTEREST AND PENALTY

If it is determined that the claimed property was not the owner’s principal residence, or the conditional requirements are not met, the

owner(s) may be subject to additional tax plus penalty and interest as determined under the General Property Tax Act.

1

1 2

2