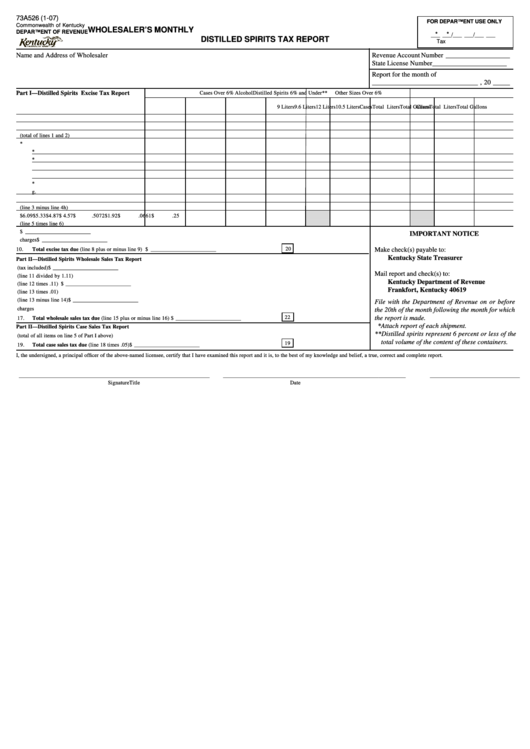

73A526 (1-07)

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

WHOLESALER’S MONTHLY

DEPARTMENT OF REVENUE

*

*

___ ___ / ___ ___ / ___ ___

DISTILLED SPIRITS TAX REPORT

Tax

Mo.

Yr.

Name and Address of Wholesaler

Revenue Account Number ___________________

State License Number ______________________

Report for the month of

_______________________________ , 20 _____

Part I—Distilled Spirits Excise Tax Report

Cases Over 6% Alcohol

Other Sizes Over 6%

Distilled Spirits 6% and Under**

12 Liters

10.5 Liters

9.6 Liters

9 Liters

Cases

Total Liters

Total Gallons

Cases

Total Liters

Total Gallons

1.

Spirits received from all sources

2.

Inventory at beginning of month

3.

Total spirits available (total of lines 1 and 2)

4.

a. Exports*

b. Spirits returned to vendors*

c. Spirits delivered to other KY wholesalers*

d. Tax paid spirits returned by KY retailers

e. Inventory at end of month

f. Sales to federal government*

g.

h. Total of lines a through g

5.

Balance subject to tax (line 3 minus line 4h)

6.

Excise tax rate

$

6.09

$

5.33

$

4.87

$

4.57

$

.5072

$

1.92

$

.0661

$

.25

7.

Tax applicable (line 5 times line 6)

8.

Total of all items on line 7 ...................................................................................................................................................... $ ________________________

IMPORTANT NOTICE

9.

Miscellaneous credits and charges ......................................................................................................................................... $ ________________________

20

10.

Total excise tax due (line 8 plus or minus line 9) ......................................................................................................

$ ________________________

Make check(s) payable to:

Kentucky State Treasurer

Part II—Distilled Spirits Wholesale Sales Tax Report

11.

Gross receipts from sales of spirits reported on line 5 of Part I above (tax included) ........................................................

$ ________________________

Mail report and check(s) to:

12.

Taxable receipts (line 11 divided by 1.11) ..........................................................................................................................

________________________

Kentucky Department of Revenue

13.

Gross tax applicable (line 12 times .11) ................................................................................................................................

$ ________________________

Frankfort, Kentucky 40619

14.

Collection and reporting fee (line 13 times .01) ...................................................................................................................

________________________

15.

Net tax due (line 13 minus line 14) .......................................................................................................................................

$ ________________________

File with the Department of Revenue on or before

16.

Miscellaneous credits and charges .........................................................................................................................................

_______________________

the 20th of the month following the month for which

22

the report is made.

17.

Total wholesale sales tax due (line 15 plus or minus line 16) ..................................................................................

$ ________________________

*Attach report of each shipment.

Part II—Distilled Spirits Case Sales Tax Report

**Distilled spirits represent 6 percent or less of the

18.

Cases subject to tax (total of all items on line 5 of Part I above) .........................................................................................

________________________

total volume of the content of these containers.

19

19.

Total case sales tax due (line 18 times .05) ................................................................................................................

$ ________________________

I, the undersigned, a principal officer of the above-named licensee, certify that I have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete report.

______________________________________________________________________

___________________________________________________________________

_________________________________

Signature

Title

Date

1

1