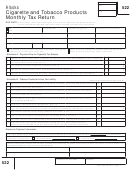

Other Tobacco Products (OTP) Form 2 Instructions

A credit must be granted for any products made from tobacco, other than cigarettes, shipped from this State and destined for retail sale

and consumption outside the State on which the tax has previously been paid. A duplicate or copy of the invoice is required for proof of

the sale outside the State.

A credit must be granted for any products made from tobacco, other than cigarettes, that are sold to any person if sold and delivered on

an Indian reservation or colony where an excise tax has been imposed which is equal to or greater than the rate of tax imposed

pursuant to NRS 370.501; or if? an Indian and if sold and delivered on an Indian reservation or colony where no excise tax has been

imposed or the excise tax is less than the rate of the tax imposed pursuant to NRS 370.501.

A credit must be granted for any products made from tobacco, other than cigarettes, that are sold to the U.S. Government for the

purposes of the Army, Air Force, Navy or Marine Corps and are shipped to a point within this State to a place which has been lawfully

ceded to the United States Government for the purposes of the Army, Air Force, Navy or Marine Corps.

The Department shall allow a credit of 30 percent of the wholesale price, less a discount of one half of one percent (0.5%) for the

services rendered in collecting the tax, for products made from tobacco, other than cigarettes, upon which the tax has been paid

pursuant to NRS 370.450 and that may no longer be sold. If the products have been purchased and delivered, a credit memo from the

manufacturer is required for proof of returned merchandise along with proof the product was sold and returned by your customer.

Instructions:

1.

Please use a separate form for each type of transaction.

2.

Fill in the 10 digit Taxpayer Identification Number and the 3 digit Location Number, Wholesale Dealer Name, Wholesale Dealer

Mailing Address, and the reporting period.

3.

Check one box for each type of transaction.

4.

Date: Fill in the date from each invoice.

5.

Invoice No.: Fill in the invoice number from each invoice.

6.

Name of Customer: Fill in the name of the customer to whom the product was sold or distributed.

7.

Address of Customer: Fill in the complete address (street number, street name, city, state, and zip code) of the customer where

the product was shipped.

8.

Wholesale Price: Fill in the total wholesale price of products sold or distributed from each invoice. Wholesale price means the

established price for which a manufacturer sells a product made from tobacco, other than cigarettes, to a wholesale dealer before

any discount or other reduction is made; or for a product made from tobacco, other than cigarettes, sold to a retail dealer or an

ultimate consumer by a wholesale dealer who manufactures or produces products made from tobacco, other than cigarettes, within

this State and who sells or distributes those products within this State to other wholesale dealers, retail dealers or ultimate

consumers, the established price for which the product is sold to the retail dealer or ultimate consumer before any discount or other

reduction is made.

9.

Total Wholesale Price: Total the Wholesale Price column and enter total here. Transfer this total to the applicable line

(line 2, 3, 4 or 5) on Form OTP 01.

If you have questions concerning this form, please call (775) 684-2129.

OTP-02 Instructions

REVISED 01-01-08

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9