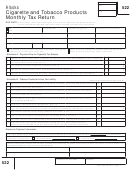

Licensed Distributor Reporting Form Instructions for Cigarette and Roll Your Own (RYO) Sales of Non-Participating

Manufacturer Brands (Other Tobacco Products Form 3)

Pursuant to Chapters 370A and 370 of the Nevada Revised Statutes, the Department of Taxation is required to compile information

regarding cigarettes and roll-your-own tobacco sold in this State.

You must complete this report and include it with your inventory report or Other Tobacco Products return for the month even if you

did not purchase any cigarettes or RYO from a Non-Participating Manufacturer, either directly or through a distributor. The

Department maintains a Tobacco Directory that lists all brands of tobacco that can be sold in Nevada, and the manufacturers of those

brands. This list contains both Participating Manufacturer (manufacturers that are parties to the National Tobacco Master Settlement

Agreement), and Non-Participating Manufacturers (manufacturers that are not parties to the National Tobacco Master Settlement

Agreement), and can be found at

Complete this report in full. Attach the report to your monthly Other Tobacco Products Return and mail to the Department of

Taxation, 1550 College Parkway Suite 115, Carson City, NV 89706, on or before the 20th of the following month. Retain a copy for

your files. If more space is required, you may copy this report.

Pursuant to NRS 370.250, failure to file this report may result in suspension of your license. The Department may also impose

a penalty of $1,000.00 for the first violation within 7 years, $5,000.00 for a second or subsequent violation within 7 years, or

revocation of your license for a third or subsequent violation within 7 years.

This report must be completed for every cigarette brand (i) that is stamped for sale within this State, and (ii) that is a Non-Participating

Manufacturer (NPM) brand as listed on the Tobacco Directory. If a wholesale dealer affixes a Nevada revenue stamp or a Tribal

stamp to a pack of cigarettes manufactured by an NPM, those cigarettes must be included on this report whether, at the time the stamp

was affixed, those cigarettes were owned by the wholesale dealer or a person other than the wholesale dealer. This report must also be

completed for every ounce of RYO sold by the wholesale dealer within this State that is a NPM brand as listed on the Tobacco

Directory.

( A ) Enter the full brand name of the product sold (do not abbreviate). Do not break down into sub-categories, such as regular,

menthol, light, etc. For example, for a cigarette named "Alpha Bravo Gold Menthol Lights", report only “Alpha Bravo Gold". Do not

report as "A B Gold" or "A B Gold Menthol Lights".

( B ) Enter the number of individual NPM cigarettes sold monthly in Nevada in packages bearing the excise tax stamp of this State.

List only cigarettes contained in packages to which you affixed the excise tax stamp of Nevada. Be sure to include any cigarettes in

which you affixed a Nevada excise tax stamp, whether or not those cigarettes were owned by you or another wholesaler. Do not list

cigarettes that were purchased with the Nevada tax stamp already affixed. Do not list cigarettes which were stamped with a Nevada

excise tax stamp by another licensed wholesaler.

( C ) Enter the number of individual NPM cigarettes sold monthly in Nevada in packages bearing a Tribal stamp. List only cigarettes

contained in packages to which you affixed the Tribal stamp for Nevada. Be sure to include any cigarettes in which you affixed a

Nevada Tribal stamp, whether or not those cigarettes were owned by you or another wholesaler. Do not list cigarettes that were

purchased with the tribal stamp already affixed. Do not list cigarettes which were stamped with Nevada Tribal stamps by another

licensed wholesaler.

( D ) Enter the ounces of RYO, for each NPM RYO brand sold by the wholesale dealer (other than tribal sales). Do not convert RYO

ounces to cigarettes.

( E ) Enter the ounces of RYO, for each NPM RYO brand sold by the wholesale dealer to a tribal entity. Do not convert RYO ounces

to cigarettes.

( F ) Enter the name and address of the non-participating manufacturer of the brand (if known).

( G ) Enter the name and address of the person from whom each brand was purchased if different from the person identified in

Column F.

( H ) Enter the name and address of the importer of the brand (if known).

OTP-03 Instructions

REVISED 01-01-08

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9