4813, Page 3

Instructions for Form 4813

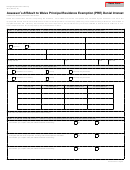

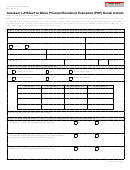

Assessor’s Affidavit to Waive Principal Residence Exemption (PRE) Denial Interest

This Affidavit enables an assessor to request the waiver of interest on tax set forth in a corrected or supplemental tax bill on behalf of a

property owner for the current tax year and the immediately preceding three tax years. The assessor for the local unit of government where

the property is located is responsible for completing this Affidavit and submitting it to the Department of Treasury (Treasury) along with

supporting documentation.

Upon reviewing the completed Affidavit and supporting documentation to determine whether the interest should be waived, Treasury

will send a written determination to the assessor, property owner and county treasurer where the property is located. Only errors detailed

in Subsection 8 of Michigan Compiled Law 211.7cc will be considered. Treasury is the only entity with authorization to waive interest.

A Board of Review, local unit officials, county officials, Michigan Tax Tribunal, and any other person or entity do not have the statutory

authority to waive interest on a corrected or supplemental tax bill resulting from a PRE denial.

PART 1: PROPERTY INFORMATION

The information in Part 1 is required for Treasury to process the waiver request. Use a separate Affidavit for each property tax identification

number. It is important to provide the property owner’s mailing address to ensure Treasury’s determination is received by the property

owner. A detailed letter from the property owner requesting a waiver of interest must be submitted with this Affidavit.

PART 2: PRE DENIAL AND INTEREST INFORMATION

A copy of the PRE denial notice that resulted in the corrected or supplemental tax bill(s) must be submitted with this Affidavit. In addition,

a copy of the relevant corrected or supplemental tax bill(s) also must be submitted. Include a breakdown, by year, of the tax bill(s) under

review and the total amount of interest to be considered by Treasury. Part 2 must be completed, and the required attachments included, in

order for Treasury to consider a waiver.

PART 3: ERROR INFORMATION

A. If the corrected or supplemental tax bill(s) was a result of a classification error, the error must be thoroughly detailed in this section.

Copies of tax bills, assessment notice(s) and other supporting documents for the relevant years showing the error must be submitted

with this Affidavit.

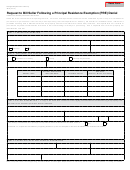

B. If the corrected or supplemental tax bill(s) was a result of an assessor’s failure to rescind the exemption after the owner requested in

writing that the exemption be rescinded, the error must be thoroughly detailed in this section. Copies of an appropriately date-stamped

Request to Rescind Homeowner’s Principal Residence Exemption, Form 2602, or other similar request to rescind the exemption must

be submitted with this Affidavit.

C. If the corrected or supplemental tax bill(s) was a result of some other error, the error must be thoroughly detailed in this section. Any

supporting documents must be submitted with this Affidavit.

PART 4: ASSESSOR INFORMATION

Provide the name of the assessor who is responsible for the error detailed in Part 3 if the assessor is not the assessor certifying this Affidavit

in Part 5. Include the certification level, certificate number, local unit and the dates the assessor was employed or contracted by the local

unit.

PART 5: CERTIFICATION

The assessor of the local unit of government where the property is located must certify that the information provided in the Affidavit and the

attached documents is true and correct to the best of his or her knowledge. Treasury will not consider a request to waive interest without this

certification. The assessor’s certification level and certificate number assigned by the State Tax Commission must be provided. A mailing

address and e-mail address is necessary for future communications.

PART 6: NOTARIzATION

The Affidavit must be notarized by a Notary Public for the State of Michigan.

The completed Affidavit and supporting documents must be mailed to the address at the bottom of the Affidavit. Failure to thoroughly

complete the Affidavit or to provide adequate supporting documentation will result in the denial of the waiver request. Treasury reserves

the right to deny any request for a waiver of interest on any tax set forth in a corrected or supplemental tax bill. There is no appeal right

afforded an assessor or property owner following a denial by Treasury of a waiver of interest request.

1

1 2

2 3

3