• Enter on Line 1 the amount of sales which are transacted wholly in Missouri. Enter on Line 1a the amount of sales in Missouri.

• Enter on Line 2 the amount of sales which are transacted partly within Missouri and partly without Missouri.

• Enter on Line 3 the amount of sales which are transacted wholly without Missouri.

• In determining income from Missouri sources in cases where sales do not express the volume of business, enter on Line 1 the amount

of business transacted wholly in Missouri and enter on Line 2 the amount of business transacted partly in Missouri and partly outside Missouri.

• Enter on Line 4a the amount of total sales.

• Attach an explanation reconciling Line 4 or Line 4a with specific data on Federal Form 1120S.

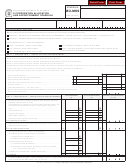

Method Two

Method Two A

Business Transaction Single Factor Apportionment

Optional Single Sales Factor Apportionment

1. Amount of sales wholly in Missouri . .

1

00 1a. Amount of sales in Missouri . . . . . . . .

1a

00

2. Amount of sales partly within and

partly without Missouri . . . . . . . . . . .

2

00

3. Amount of sales wholly without

Missouri . . . . . . . . . . . . . . . . . . . . . .

3

00

4. Total amount ‑ all sources ‑

Add Lines 1, 2, and 3 . . . . . . . . . . . .

4

00 4a. Amount of total sales . . . . . . . . . . . .

4a

00

5. One‑half of Line 2 . . . . . . . . . . . . . . .

5

00

6. Total amount Missouri ‑

Add Lines 1 and 5. . . . . . . . . . . . . . .

6

00

7. Missouri single factor apportionment

7a. Missouri optional single sales factor

fraction (Divide Line 6 by Line 4). . .

apportionment fraction (Divide Line 1A by

Enter on

Schedule

MO-NRS,Parts 1

Line 4A). Enter on

Schedule

MO-NRS,

.

.

and 2, Column (c) . . . . . . . . . . . . . . .

7

%

Parts 1 and 2, Column (c) . . . . . . . .

7a

%

Directly allocable nonbusiness income. Do not allocate expenses that have been excluded from federal taxable income.

All income is presumed to be business income unless you can clearly show the income to be nonbusiness income.

Allocation of Nonbusiness Income

Gross Income

Directly Related Expenses

Indirectly Related Expenses

(1) Everywhere

(2) Missouri

(3) Everywhere

(4) Missouri

(5) Everywhere

(6) Missouri

1. Interest income .............

00

00

00

00

00

00

2. Royalties .......................

00

00

00

00

00

00

3. Rents ............................

00

00

00

00

00

00

4. Net capital gains ...........

00

00

00

00

00

00

5. Dividends ......................

00

00

00

00

00

00

6. Total each column ........

00

00

00

00

00

00

Example: Assume S corporation’s only activity is a 10

The following steps must be followed for each distributive share item that is

percent ownership in partnership. Partnership’s Schedule

being allocated as nonbusiness income. Attach an explanation and computa‑

MO‑MSS reflects single factor with $1,000,000 as wholly

tions detailing the nature of the nonbusiness or Missouri source income.

within and $275,000 as partly within. S corporation method

Example: Assume $15,000 in total rents of which $12,000 is business

2 Single Method Apportionment is calculated as follows:

income and $3,000 is nonbusiness of which $1,000 is directly allocated to

Missouri income. Assume an apportionment factor of 33.333% (from Part 1,

1. Amount wholly in Missouri

Line 4 or Part 2, Line 7 or Line 7a):

($1,000,000 x .10)

=

$100,000

2. Amount wholly within and without

Step

Missouri ($275,000 x .10)

=

$27,500

1

$15,000 Total rents

2

– 3,000 Allocated to Missouri as nonbusiness or Missouri source income

3. Amount wholly without Missouri

(0 x .10)

=

$0

$12,000 Business income

4. Total amount (all source) = $127,500

3

$12,000 X 33.333% = $4,000

5. One half of Line 2

=

$13,750

4

$1,000 Missouri source income

6. Total Amount (Missouri) add Line 1

5 + $4,000 From Step 3

and Line 5

=

$113,750

$5,000 Enter on

Schedule

MO-NRS, Part 1, Line 3, Column (b).

7. Missouri Single Factor Apportionment

(Divide Line 6 by Line 4) Enter on

6

$5,000/15,000 = 30% This percentage is entered on

Schedule

Schedule

MO-NRS, Parts 1 and 2,

MO-NRS, Part 1, Line 3, Column (c).

Column (e).

=

89.216%

Form MO‑MSS (Revised 11‑2013)

Taxation Division

Phone: (573) 751‑4541

P.O. Box 3365

Fax: (573) 522‑1721

Visit

Jefferson City, MO 65105‑3365

E-mail:

corporate@dor.mo.gov

for additional information.

1

1 2

2