Net Operating Loss Addition Modification Sheet Instructions

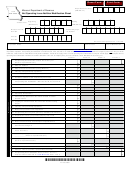

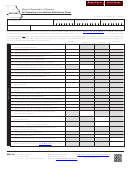

Use this form for corporations that 1) reported a net operating loss (NOL) deduction for carryback years on the Federal Form 1120 -Line

29A, Federal Form 1139, or Federal Form 1120X and 2) used the loss to offset Missouri net positive additions in the year of the initial loss.

If both do not apply, there is no net operating loss modification. If both apply, then complete the net operating loss addition modification

worksheet. If the NOL deduction is the sum of multiple years, you must complete a Form MO-5090 for each loss year.

1.

Enter on Line 1, Columns 1 and 4, the amount of the net operating loss deduction attributable to the loss year from Federal

Form 1120, Line 29a of the carryover year or from Federal Form 1139 or Federal Form 1120X for carryback years. This is the

amount of the deduction utilized in the current year.

2.

Enter on Lines 2a through 2e all required additions from the loss year to federal taxable income, except for the net operating

loss modification. See

Section 143.121.2(3), RSMo

regarding the Missouri depreciation basis adjustment for Line 2d.

3.

Add Lines 2a through 2d and enter the total on Line 3 to compute all required additions from the loss year to federal taxable

income.

4.

Enter on Lines 4a through 4l all required subtractions from federal taxable income from the loss year.

See

Section 143.121.3(2), RSMo

and

12 CSR 10-2.020

regarding the reduction in gain due to basis difference for Line 4c. See

Section 143.121.3(7), RSMo

regarding the Missouri depreciation basis for Line 4h.

See

Section 143.121.2(4), RSMo

regarding the net operating loss carryback previously disallowed for Missouri on Line 4i. See

Section 143.121.3(9), RSMo

regarding the depreciation recovery on qualified property that is sold for Line 4j. See

Section 108.1020, RSMo

regarding the

build America and recovery zone bond interest for Line 4k.

See

Section 227.646, RSMo

regarding the Missouri

Public-Private Partnerships Transportation Act for Line 4l.

5.

Add Lines 4a through 4l and enter the total on Line 5 to compute all required subtractions from the loss year from federal taxable

income.

6.

Subtract Line 5 from Line 3 and enter on Line 6 (but not less than zero). This will give you the net addition modification, as the

amount that all required additions exceeds all required subtractions.

7.

Enter the total amount of the net operating loss from Federal Form 1120, Line 30 of the loss year in Column 3 and enter the tax

year of the net operating loss in the blank provided.

8.

Enter the amount of the net operating loss deduction utilized in prior years from Federal Form 1120, Line 29a from all prior carryover

years of this loss year or from Federal Form 1139 or Federal Form 1120X from the carryback years.

9.

Add Lines 1 and 8 and enter on Line 9

10.

Add Lines 6 and 9 and enter on Line 10.

11.

Subtract Line 7 from Line 10 (but not less than zero) and enter on Line 11.

12.

Enter the lesser of Line 1 or 11 on Line 12 and also on Form MO-1120, Part 1, Line 3.

Note: You must specifically identify each loss year that is part of the net operating loss deduction and a separate Form MO-5090 must

be completed for each loss year.

Note: The above items are each considered to be a positive amount for purposes of this calculation. If the result of combining amounts

is negative, use zero.

Frequently Asked Questions

1.

If a taxpayer has incurred a net operating loss, when is a net operating loss addition modification computed?

A net operating loss addition modification is computed when a net operating loss deduction is claimed. If there was a net

operating loss for the tax year 2012 and the taxpayer carried it back two years and claimed a net operating loss deduction on

an amended federal return for tax year 2010, then a net operating loss addition modification would be computed for the 2010

amended Missouri return.

2.

Is the Net Operating Loss Addition Modification computed for the year of the loss?

No, it is computed for the year a net operating loss deduction is used.

3.

If a taxpayer has claimed a net operating loss deduction on its federal return and in the year the initial loss was incurred,

its Missouri addition modifications are less than its subtraction modifications, does it have to compute a net operating loss

modification?

No, there is no net operating loss addition modification attributable to that net operating loss because in the year of the initial

loss, the Missouri addition modifications were less than the Missouri subtraction modifications.

4.

If the net operating loss deduction is composed of net operating loss amounts from more than one year, is there more than one

net operating loss addition modification?

Yes, a net operating loss addition modification must be computed for each net operating loss included in the net operating loss

deduction.

5.

If more than one net operating loss addition modification is computed, in what order are the amounts computed?

The net operating loss addition modifications are computed in the same order the net operating losses are used as net operating

loss deductions for federal income tax purposes.

Form MO-5090 (Revised 10-2013)

1

1 2

2