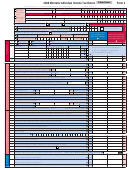

Form 2, Page 2 – 2013

Social Security Number:

Column A (for single,

Column B (for spouse

joint, separate, or head

when fi ling separately

of household)

using fi ling status 3a)

23 Your total income from line 22 .............................................................................................................

23

00

00

24 Educator expenses ..............................................................................................................................

24

00

00

25 Certain business expenses of reservist, etc. Include federal Form 2106 or 2106-EZ .........................

25

00

00

26 Health savings account deduction. Include federal Form 8889 ...........................................................

26

00

00

27 Moving expenses. Include federal Form 3903 .....................................................................................

27

00

00

28 Deductible part of self-employment tax. Attach federal Schedule SE .................................................

28

00

00

29 Self-employed SEP, SIMPLE, and qualifi ed plans ...............................................................................

29

00

00

30 Self-employed health insurance deduction ..........................................................................................

30

00

00

31 Penalty on early withdrawal of savings ................................................................................................

31

00

00

32a Alimony paid ........................................................................................................................................ 32a

00

00

32b Recipient’s SSN ............................ 32b

33 IRA deduction ......................................................................................................................................

33

00

00

34 Student loan interest deduction ...........................................................................................................

34

00

00

35 Tuition and fees ...................................................................................................................................

35

00

00

36 Domestic production activities deduction. Include federal Form 8903 ................................................

36

00

00

37 Add lines 24 through 36 and enter the result here.

Federal write-ins ......................

37

00

00

38 Subtract line 37 from line 23 and enter the result here ........................................................................

38

00

00

38a Combine amounts on line 38 columns A and B and enter here. This is your federal adjusted gross income. .... 38a

00

39 Enter Montana additions to federal adjusted gross income from Form 2, page 4, Schedule I,

line 17 ..................................................................................................................................................

39

00

00

40 Enter Montana subtractions from federal adjusted gross income from Form 2, page 5,

Schedule II, line 35 ..............................................................................................................................

40

00

00

41 Add lines 38 and 39; subtract line 40. This is your Montana adjusted gross income. .........................

41

00

00

42 Deductions

Standard Deduction (see Worksheet V on page 46)

}

Must mark

OR

one box.

Itemized Deductions (from Form 2, Schedule III, line 30) ................

42

00

00

43 Subtract line 42 from line 41 and enter the result here. .......................................................................

43

00

00

44 Exemptions (All individuals are entitled to at least one exemption.) Multiply $2,280 by the

number of exemptions on line 6d and enter the result here ................................................................

44

00

00

45 Subtract line 44 from line 43 and enter the result here. This is your taxable income. .....................

45

00

00

46 Tax from the tax table on page 7 or from Form 2, page 4. If line 45 is zero or less than zero,

enter zero ............................................................................................................................................

46

00

00

47 2% capital gains tax credit ...................................................................................................................

47

00

00

48 Subtract line 47 from line 46; enter the result here, but not less than zero.

This is your resident tax after capital gains tax credit. ..................................................................

48

00

00

48a Nonresident, part-year resident tax after capital gains tax credit. Enter here the amount from

Form 2, Schedule IV, line 25, but not less than zero ........................................................................... 48a

00

00

49 Tax on lump-sum distributions. Include federal Form 4972 .................................................................

49

00

00

50 Add lines 48 or 48a and 49 and enter the result here. This is your total tax. ...................................

50

00

00

51 Enter the amount from Form 2, Schedule V, line 23, but do not enter an amount larger than the

amount on line 50. This is your total nonrefundable credits. .........................................................

51

00

00

52 Recapture tax(es) (see instructions on page 8)

Code

Code .....

52

00

00

53 Add lines 50 and 52, then subtract the amount on line 51 and enter the result here.

This is your 2013 tax liability. ...........................................................................................................

53

00

00

Questions? Call us toll free at (866) 859-2254 or in Helena at 444-6900 or TDD (406) 444-2830 for hearing impaired.

*13CE0201*

*13CE0201*

1

1 2

2 3

3