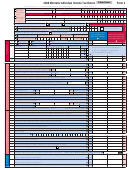

Form 2, Page 3 – 2013

Social Security Number:

Column A (for single, joint,

Column B (for spouse

separate, or head

when fi ling separately

of household)

using fi ling status 3a)

54 Your 2013 tax liability from line 53 .....................................................................................................

54

00

00

55 Montana income tax withheld. Include federal Form(s) W-2 and 1099 .............................................

55

00

00

56 Montana mineral royalty tax withheld. Include federal Form(s) 1099-MISC and Montana Schedule(s) K-1

56

00

00

57 Montana pass through entity withholding. Include Montana Schedule(s) K-1 ...................................

57

00

00

58 2013 estimated tax payments and amount applied from your 2012 return .......................................

58

00

00

59 2013 extension payments from Form EXT-13 ...................................................................................

59

00

00

60 Refundable credits from Form 2, Schedule V, line 29 .......................................................................

60

00

00

61 If fi ling an amended return: Payments made with original return ...................................................

61

00

00

62 If fi ling an amended return: Previously issued refunds ..................................................................

62

00

00

63 Add lines 55 through 61. Subtract line 62, enter the result here. This is your total payments. ......

63

00

00

64 If line 54 is greater than line 63, subtract line 63 from line 54. This is your tax due. ......................

64

00

00

65 If line 63 is greater than line 54, subtract line 54 from line 63. This is your tax overpaid. ..............

65

00

00

66 Interest on underpayment of estimated taxes (see instructions on page 10) ...........................................................................

66

00

If applicable, mark appropriate box:

2/3 farming gross income

Estimated payments were made using the annualization method

67 Late fi le penalty, late payment penalty and interest (see instructions on page 10) ..................................................................

67

00

68 Other penalties (see instructions on page 11) ..........................................................................................................................

68

00

69 Total voluntary check-off contribution programs from lines 69a through 69d ...........................................................................

69

00

69a

Nongame Wildlife Program

$5

$10

other amount

00

69b

Child Abuse Prevention

$5

$10

other amount

00

69c

Agriculture Literacy in Montana Schools

$5

$10

other amount

00

69d

Montana Military Family Relief Fund

$5

$10

other amount

00

70 Add lines 66 through 69 and enter the result. This is the sum of your total penalties, interest and contributions. .........

70

00

71 If you have tax due (amount on line 64), add lines 64 and 70 OR, if you have a tax overpayment (amount on line 65)

and it is less than line 70, subtract line 65 from line 70. Enter the result here. If married fi ling separately and there are

►

71

amounts on lines 64 and 65, please see instructions on page 12 ..................................... This is the amount you owe.

00

Pay online at revenue.mt.gov. If writing a check, make it payable to MONTANA DEPARTMENT OF REVENUE.

72 If you have a tax overpayment (amount on line 65) and it is greater than line 70, subtract line 70 from line 65 and enter

the result here. This is your overpayment. ............................................................................................................................

72

00

73 Enter the amount from line 72 that you want applied to your 2014 estimated taxes ................................................................

73

00

►

74 Subtract line 73 from line 72 and enter the result here .....................................................................This is your refund.

74

00

Direct Deposit

1. RTN#

2. ACCT#

Your Refund

Complete 1, 2, 3 and 4

3. If using direct deposit, you are required to mark one box.

Checking

Savings

(please see instructions on

page 12).

4. Is this refund going to an account that is located outside of the United States or its territories?

Yes

No

Under penalties of false swearing, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature is Required

Date

Daytime Telephone Number

Spouse’s Signature

Date

X

X

Paid Preparer’s Signature

Paid Preparer’s PTIN/SSN

Firm’s FEIN

Mark this box

Third Party Designee

Third Party Designee’s Printed Name

if you do not

Do you want to allow another person (such as a paid preparer) to

want forms and

discuss this return with us (see page 13)?

instructions mailed

Third Party Designee’s Phone Number

to you next year.

Yes

No

*13CE0301*

*13CE0301*

1

1 2

2 3

3