Instructions

Business or ordinary income is wholly attributable to Missouri if

the business is only carried on in Missouri. If not carried on only in

Schedule MO-NRS must be completed and a copy (or its information) sup-

Missouri, the income must be divided between Missouri and other

plied to the nonresident shareholder when the S corporation has: (1) a non-

state(s). See instructions for

Schedule

MO-MSS.

resident shareholder; and (2) the S corporation has income from Missouri

3.

Column (b): Multiply the amount in Column (a) by the percent in

sources. Do not complete the Schedule MO-NRS, if all shareholders are

Column (c) and enter in Column (b).

Missouri residents.

4.

Column (c): Enter the percent from Schedule MO-MSS, Line 4.

The nonresident shareholder must report his or her share of the

Missouri income and Missouri source modifications indicated on

5.

Column (d): Enter the amount from Federal Form 1120S, Schedule

Schedule MO-NRS on his or her

Form MO-1040

and

Form

MO-NRI.

K-1 for each nonresident shareholder.

6.

Column (e): Multiply the amount in Column (d) times the percent in

Any questions concerning the Form MO-1040 or Form MO-NRI

Column (c).

should be directed to Individual Income Tax at (573) 751-3505. Any

Note: The items from Schedule MO-NRS, Part 1, Column (e), that are to

questions concerning Subchapter S corporation distribution withholding

be income or losses should be entered on the Form MO-NRI, as Missouri

or shareholder composite re turns should be directed to: Department of

source income. These amounts must be adjusted by any capital gain or

Revenue, Taxation Division, P.O. Box 2200, Jefferson City, MO 65105-

passive loss limitation as required.

2200 or call (573) 751-1467.

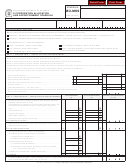

Part 2

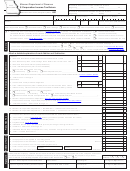

Part 1

Share Of Missouri

S Corporation’s Distributive Share Items

S Corporation Adjustment — Nonresident Shareholders

1.

Enter nonresident shareholder’s name and Social Security Number

Do not complete Part 2 of Schedule MO-NRS if the “Missouri S Corpora-

from Federal Form 1120S, Schedule K-1, for each nonresident.

tion Adjustment” and the “Allocation of Missouri S Corporation Adjustment

Enter the corporation’s Federal Employer Identification Number.

to Shareholders” on

Form MO-1120S

were not completed.

Complete a separate Schedule MO-NRS for each nonresident share-

1.

Column (a): Copy amounts from MO-1120S, Lines 1a–14.

holder.

2.

Columns (b) and (c): Amounts in Column (a) must be analyzed

2.

Column (a): Enter the amount from Federal Form 1120S,

to determine whether all or part of each amount is from Missouri

Schedule K. Note that the Schedule MO-NRS, Part 1, line numbers

sources. See instructions for Schedule MO-MSS.

and items match the Federal Form 1120S, Schedules K and K-1.

3.

Column (d): Copy amount of each nonresident shareholder’s S cor-

Amounts in Column (a) must be analyzed to determine whether

poration adjustment from Form MO-1120S, Page 2, Column 5.

all or part of each amount is from Missouri sources. These include

4.

Column (e):

Enter in Column (e) the portion of the amount in

amounts attributable to the ownership or disposition of any

Column (d) that is from Missouri sources. Generally, this is deter-

Missouri property and business income that is attributable to

mined by multiplying each shareholder’s Column (d) amount by the

Missouri sources. Whether nonbusiness income is attributable to

percent in Column (c). Attach a detailed explanation, if any other

Missouri sources is often determined by whether the property sold or

method is used.

producing income was located in Missouri.

r

r

Was the Form MO-1120S signed by an officer of the

Did you receive an extension of time to file your return? If so,

corporation?

have you attached a copy of the federal extension?

r

r

Did you review your completed return?

Have you attached a copy of the federal form and supporting

r

schedules?

Are the corporation name, address, and identification numbers

r

correctly shown on the return?

Did you attach a copy of your Balance Sheet (Federal Form

r

1120S, Schedule L, and supporting schedules)?

Did you complete all parts of the return?

r

r

Have you addressed your envelope to the proper address?

Did you complete the

Schedule

MO-FT, if liable to pay

r

Corporation Franchise Tax?

Did you enter your Missouri Tax I.D. Number?

r

If you do not know your Missouri Tax I.D. Number, an officer

Did you check Box A on Form MO-1120S if your assets in or

must call Business Registration at (573) 751-5860.

apportioned to Missouri are equal to or less than $10,000,000?

r

r

Did you enter your Charter Number? If you do not know your

Is your filing period shown on Form MO-1120S and Schedule

Charter Number, call (866) 223-6535.

MO-FT?

r

Have you verified all math calculations?

The Federal Privacy Act requires the Missouri

tax returns and other documents, to deter-

having the statutory right to obtain it [as

Department of Revenue (Department)

mine and collect the correct amount of tax,

indicated above]. In addition, information may

to inform taxpayers of the Department’s

to ensure you are complying with the tax

be disclosed to the public regarding the name

legal authority for requesting identifying

laws, and to exchange tax information with

of a tax credit recipient and the amount issued

information, including social security numbers,

the Internal Revenue Service, other states,

to such recipient

(Chapter 135,

RSMo). (For

and to explain why the information is needed

and the Multistate Tax Commission (Chapters

the Department’s authority to prescribe forms

and how the information will be used.

32

and 143, RSMo). In addition, statutorily

and to require furnishing of social security

provided non-tax uses are: (1) to provide

numbers, see Chapters 135, 143, and 144,

Chapter 143

of the Missouri Revised Statutes

information to the Department of Higher

RSMo.)

authorizes the Department to request infor-

Education with respect to applicants for finan-

mation necessary to carry out the tax laws of

You are required to provide your social

cial assistance under

Chapter 173, RSMo

the state of Missouri. Federal law 42 U.S.C.

security number on your tax return. Failure

and (2) to offset refunds against amounts

Section 405 (c)(2)(C) authorizes the states to

to provide your social security number or

due to a state agency by a person or entity

require taxpayers to provide social security

providing a false social security number may

(Chapter 143, RSMo). Information furnished to

numbers.

result in criminal action against you.

other agencies or persons shall be used solely

The Department uses your social securi-

for the purpose of administering tax laws or

ty number to identify you and process your

the specific laws administered by the person

Form MO-NRS (Revised 11-2013)

Taxation Division

Phone: (573) 751-4541

P.O. Box 3365

Fax: (573) 522-1721

Visit

Jefferson City, MO 65105-3365

E-mail:

corporate@dor.mo.gov

for additional information.

1

1 2

2