In the case of self-constructed property, the cost thereof is the amount of property charged to the capital account for purposes of depreciation.

PROPERTY PURCHASED FOR MULTIPLE BUSINESS USES

If property is purchased for multiple business use including use as a component part of a new, expanded, or ongoing industrial facility of an industrial

taxpayer together with some other business or occupation not qualifying (for example, retail selling), the use of the property in the qualified activity and

nonqualified activity must be thoroughly supported and explained by separate documents submitted with the application, and the amount of credit arising

from that property must be based on cost allocated to the qualified activity.

ELIGIBLE INVESTMENT

To determine the amount of eligible investment for the industrial expansion credit, the net cost of each property purchased is multiplied by the applicable

percentage shown below according to the useful life of the property.

If useful life is:

The applicable percentage is:

4 years or more but less than 6 years

33 1/3%

6 years or more but less than 8 years

66 2/3%

8 years or more

100 %

EXAMPLE

If a taxpayer purchases for $25,000 after July 25, 1999, a machine for use in a new, expanded, or ongoing portion of its industrial

facility, which has a useful life of 6 years, the eligible investment is equal to $16,666.66. The eligible investment is calculated by

multiplying the cost of the equipment, $25,000, times the applicable percentage according to the useful life, 66 2/3%, to arrive at

$16,666.66. The credit is equal to 10% of the eligible investment or $1,666.67. This credit must be claimed over a period of 10

years at a rate of 10% ($166.67) per year.

CREDIT RECAPTURE

Credit attributable to property that ceases to be used in this State prior to the end of its categorized useful life must be recalculated for all tax years

according to actual useful life. For example, Company A invests $10 million in equipment with a designated useful life of 8 years in 1999. The credit for

Company A is calculated to equal $1,000,000 or $100,000 per year for 10 years. However, Company A moves this equipment to New York in 2004, and

therefore the equipment’s actual useful life in West Virginia is reduced to only 5 years. The corresponding credit is reduced according to the above

formula from $1,000,000 to $333,333 or $33,333 per year for 10 years. A reconciliation statement for the 1999 through 2004 period reflecting an

overutilization of credit must then be submitted with payment of any additional tax, interest and penalties owed.

COMPUTATION OF INDUSTRIAL EXPANSION CREDIT

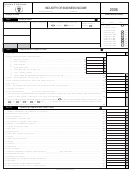

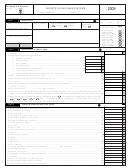

Computation of Eligible Investment:

Column 1.

Enter the net costs of the property in Column (1) on the appropriate line determined by the life of the property.

Col. 2 & 3.

Multiply the net costs in Column (1) by the applicable percentages in Column (2). Enter the results in Column 3.

Line 4.

Add the figures in Column (3) and enter on Line 4. This is the taxpayer’s eligible investment.

Computation of Potential Current Annual Credit:

Line 5.

To determine the taxpayer’s total potential current annual credit, which can be taken over a period of ten years, multiply the

total eligible investment (Line 4) by 10%. Enter the result on Line 5.

Computation of Current Annual Credit:

Line 6.

To determine the taxpayer’s annual credit earned during the current taxable year, multiply the total potential credit on Line 5 by

10%. Enter on Line 6. Forfeited if not used.

Credit From Previous Years:

Line 7.

Enter any annual Industrial Expansion or Revitalization Credit from prior year(s). For eligible investments for multiple year(s), a

worksheet must be provided showing the computation.

1

1 2

2 3

3 4

4