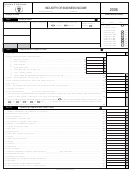

Computation of Total Annual Credit:

Line 8.

To determine the total amount of credit available in the current taxable year, add the credit earned during the current year

shown on Line 6 to the amounts available from previous years shown on Line 7. Enter the total on Line 8.

Line 9a

Enter total of pre-credit Business and Occupation Tax liability.

Line 9b.

Enter sum of Business Investment and Jobs Expansion Credit (Super Credit), Economic Opportunity Credit, Research and

Development Project Credit, Residential Housing Development Project Credit and Coal Loading Facilities Credit, if any, applied

against your Business and Occupation Tax liability.

Line 9c.

Subtract Line 9b from Line 9a.

Line 9d.

Enter 50% of Line 9a.

Line 9e.

Enter sum of Research and Development Project Credit and Residential Housing Development Credit, if any, applied against

your Business and Occupation Tax liability.

Line 9f.

Subtract Line 9e from Line 9d.

Line 9g.

Enter the lesser of Line 8, or Line 9c, or Line 9f. This represents the maximum Industrial Expansion or Revitalization Credit

available against your Business and Occupation Tax liability.

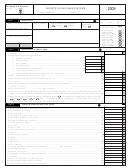

Line 10a.

Enter your total amount of Business Franchise Tax remaining after deductions for the Subsidiary Credit and Business and

Occupation Credit.

Line 10b.

Enter sum of Business Investment and Jobs Expansion Credit (Super Credit), Research and Development Project Credit,

Residential Housing Development Project Credit and Coal Loading Facilities Credit, if any, applied against your Business

Franchise Tax liability.

Line 10c.

Subtract Line 10b from Line 10a.

Line 10d.

Enter 50% of Line 10a.

Line 10e.

Enter sum of Research and Development Project Credit and Residential Housing Development Credit, if any, applied against

your Business Franchise Tax liability.

Line 10f.

Subtract Line 10e from Line 10d.

Line 10g.

Enter the lesser of Line 8, or Line 10c, or Line 10f. This represents the maximum Industrial Expansion or Revitalization Credit

available against your Business Franchise Tax liability.

1

1 2

2 3

3 4

4