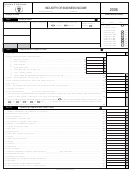

Schedule I-EPP

Rev 1/06

Credit for Industrial Expansion or Revitalization – Electric Power Producers

Business Name ___________________________________ Identification Number ___________________________

Tax Period____________________ To ____________________

Computation of Eligible Investment

(Column 1)

(Column 2)

(Column 3)

Net Cost

Percentage

Allowable Cost

Investment

1.

Expansion or Revitalization property with useful life of

$ _____________

33 1/3%

$______________

4 years or more but less than 6 years

2.

Expansion or Revitalization property with useful life of

$ _____________

66 2/3%

$______________

6 years or more but less than 8 years

3.

Expansion or Revitalization property with useful life of

$ _____________

100%

$______________

8 years or more

4.

Total Eligible Expansion or Revitalization Investment

$______________

5.

Total Potential Expansion Credit (10% of Line 4)………………………………………………………………………………..…………. $_____________

6.

Available Annual Expansion Credit (10% of Line 5) (Forfeited if not used)………………………………………………………………$_____________

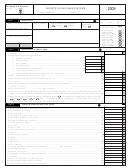

7.

Available Annual Expansion or Revitalization Credit from prior years (incomplete information will result in the disallowance of the credit)

Reference Period

(Number of Years

Original Available

Net Available

Prior to Current

Tax Period)

Tax Period Ending*

Annual Credit

Adjustments**

Annual Credit

9

______________

_________________

____________

___________

8

______________

_________________

____________

___________

7

______________

_________________

____________

___________

6

______________

_________________

____________

___________

5

______________

_________________

____________

___________

4

______________

_________________

____________

___________

3

______________

_________________

____________

___________

2

______________

_________________

____________

___________

1

______________

_________________

____________

___________

Total

___________

**Adjustments, including the disposal of property or machinery before the originally stated useful life, may also result in the recapture of credit previously

claimed. See the instructions.

8.

Total available Annual Expansion or Revitalization Credit (Line 6 plus Total from Line 7)…………………………………………… $_____________

9.

a)

Total Business and Occupation Tax…………………………………………………………..

$_____________

b)

Amount of Other Credits Claimed………………………………………………………………

$_____________

c)

Net Limit (9a-9b)………….……………………………………………………………………...

$_____________

d)

Credit Limit (50% of 9a)…………………………………………………………………………

$_____________

e)

Amount of Other §11-13D Credits Claimed.………………………………………………….

$_____________

f)

Net §11-13D Limit (9d-9e)…………………………………………………………………….…

$_____________

g)

Industrial Expansion or Revitalization Credit Offset………..………………………………..

$_____________

10.

a)

Total Business Franchise Tax…………………………………………………………..………..

$_____________

b)

Amount of Other Credits Claimed………………………………………………………………

$_____________

c)

Net Limit (10a-10b)…………………………………………………………………….………..

$_____________

d)

Credit Limit (50% of 10a)………………………………………………………………………..

$_____________

e)

Amount of Other §11-13D Credits Claimed……………………………………….………….

$_____________

f)

Net §11-13D Limit (10d-10e)…………………………………………………………………...

$_____________

g)

Industrial Expansion or Revitalization Credit Offset………………………………………….

$_____________

11.

Total credit claimed lines 9g + 10g ………………………………………………….

$_____________

Note that the sum of credit claimed on Lines 9g and 10g may not exceed 50% of the sum of the liabilities reported on Lines 9a and 10a. This 50% also

applies to the sum of all tax credits claimed under § 11-13D and of the West Virginia Code (i.e. Research and Development Credit, Residential Housing

Development Credit). Unused annual credit is forfeited.

1

1 2

2 3

3 4

4