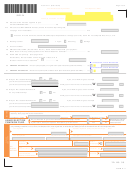

Form N-11 (Rev. 2012)

Page 3 of 4

Your Social Security Number

Your Spouse’s SSN

JBF123

Name(s) as shown on return

25

If line 20 is $89,981 or less, multiply $1,040 by the total number of exemptions claimed on

line 6e. Otherwise, see page 21 of the Instructions. If you and/or your spouse are blind, deaf,

or disabled, place an X in the applicable box(es), and see page 21 of the Instructions.

Spouse ............................................................................................... 25

Yourself

26

Taxable Income. Line 24 minus line 25 (but not less than zero) ...................Taxable Income ä 26

27

Tax. Place an X if from

Tax Table;

Tax Rate Schedule; or

Capital Gains Tax

Worksheet on page 37 of the Instructions.

(

Place an X if tax from Forms N-2, N-103, N-152, N-168, N-312, N-318, N-338,

N-344, N-405, N-586, N-615, or N-814 is included.) .......................................................... Tax ä 27

27a

If tax is from the Capital Gains Tax Worksheet, enter

the net capital gain from line 14 of that worksheet .......... 27a

28

Refundable Food/Excise Tax Credit

(attach Schedule X) DHS, etc. exemptions

.... 28

29

Credit for Low-Income Household

Renters (attach Schedule X) ............................................. 29

30

Credit for Child and Dependent

Care Expenses (attach Schedule X) ................................. 30

31

Credit for Child Passenger Restraint

System(s) (attach a copy of the invoice)............................ 31

32

Total refundable tax credits from

Schedule CR (attach Schedule CR) .................................. 32

33

Add lines 28 through 32 ................................................................. Total Refundable Credits ä 33

t

IF NEGATIVE, PLACE MINUS SIGN

-

34

Line 27 minus line 33. If line 34 is zero or less, see Instructions. .................................................. 34

35

Total nonrefundable tax credits (attach Schedule CR) .................................................................. 35

t

IF NEGATIVE, PLACE MINUS SIGN

-

36

Line 34 minus line 35 ................................................................................................. Balance ä 36

37

Hawaii State Income tax withheld (attach W-2s)

(see page 26 of the Instructions for other attachments) .................. 37

38

2012 estimated tax payments............................................ 38

39

Amount of estimated tax applied from 2011 return ........... 39

40

Amount paid with extension............................................... 40

41

Add lines 37 through 40 ................................................................................. Total Payments ä 41

42

If line 41 is larger than line 36, enter the amount OVERPAID (line 41 minus line 36) (see Instructions) .. 42

43

Contributions to (see page 27 of the Instructions): ........................

Yourself

Spouse

43a Hawaii Schools Repairs and Maintenance Fund .....................

$2

$2

43b Hawaii Public Libraries Fund ...................................................

$2

$2

43c Domestic and Sexual Violence / Child Abuse and Neglect Funds .............

$5

$5

44

Add the amounts of the Xs on lines 43a through 43c and enter the total here ............................. 44

45 Line 42 minus line 44 ........................................................................................................ 45

ID NO 99

FORM N-11

1

1 2

2 3

3 4

4 5

5 6

6