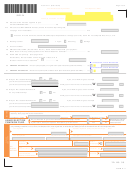

Schedule CR

Page 2

(Rev. 2012)

Name(s) as shown on return

SSN(s) or Federal Employer I.D. No.

YBF122

Refundable Tax Credits

PART II

15 Capital Goods Excise Tax Credit (attach Form N-312) .............................................. 15

16 Fuel Tax Credit for Commercial Fishers (attach Form N-163) .................................... 16

17 Ethanol Facility Tax Credit (attach Form N-324)......................................................... 17

18 Motion Picture, Digital Media, and Film Production Income

Tax Credit (attach Form N-340) .................................................................................. 18

19 Renewable Energy Technologies Income Tax Credit (For Systems Installed and

Placed in Service on or After July 1, 2009) (attach Form N-342)

Place an X in the appropriate box to indicate the type of energy system installed and placed in service:

•

•

Solar

Wind ................................................................................ 19

20 Important Agricultural Land Qualified Agricultural Cost Tax Credit (attach Form N-344) ....................... 20

21 Other refundable credits

a. Pro rata share of taxes withheld

and paid by a partnership, estate,

trust, or S corporation on the sale

of Hawaii real property interests ........... 21a

b. Credit From a Regulated

Investment Company ............................ 21b

c. Add lines 21a and 21b ......................................................................................... 21c

22 Total Refundable Credits. Add lines 15 through 20 and line 21c. Enter

here and on Form N-11, line 32; N-15, line 48; N-30, line 12; or

N-70NP, line 17. Attach this schedule directly behind your

Form N-11, N-15, N-30, or N-70NP. .......................................................................... 22

ID NO 99

Page 2

SCHEDULE CR

1

1 2

2 3

3 4

4 5

5 6

6