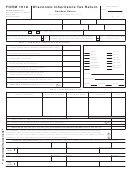

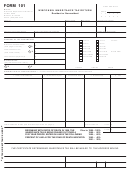

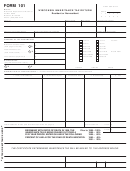

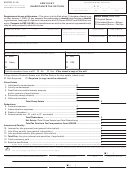

Form 101a - Wisconsin Inheritance Tax Return Page 2

ADVERTISEMENT

Page 2

PART 3 – SOLELY OWNED PROPERTY

If there is real estate, attach a copy of the property tax bill or appraisal for each parcel.

$

Total ......................................................................................................................................................

Less: Household goods and tangible personal property exemption (see instructions) ..........................

$

Net Amount (enter on line 1, Part 1) .....................................................................................................

PART 4 – JOINTLY OWNED PROPERTY

SECTION 1 – FRACTIONAL SHARE BASIS (real estate and other complete transfers – see instructions)

Total ......................................................................................................................................................

$

Less: Mortgages and liens ....................................................................................................................

Net Amount (enter on line 4, Part 1) .....................................................................................................

$

SECTION 2 – CONTRIBUTION BASIS (incomplete transfers – see instructions)

Total ......................................................................................................................................................

$

Less: Survivor’s contribution (must be supported by affidavit – see instructions) ..................................

Net Amount (enter on line 5, Part 1) .....................................................................................................

$

PART 5 – ALLOWABLE DEDUCTIONS

REQUIRED INFORMATION

Debts outstanding at death

Will the Closing Certificate for Fiduciaries

1.

$

(attach list if debts exceed $1,500)

(also called the “income closing certificate”)

be needed to close this estate with the

Circuit Court?

2.

Expenses of last illness

Yes

No

3.

Funeral and burial expenses

If “yes”, it is suggested that the request

4.

Expenses of administration

for this certificate along with any required

fiduciary returns accompany the inheritance

tax return when it is filed.

5.

TOTAL DEDUCTIONS (Enter on line 2, Part 1)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4