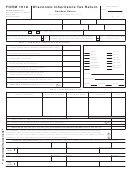

Form 101a - Wisconsin Inheritance Tax Return Page 4

ADVERTISEMENT

undertaker, the remaining portion of the bill paid is deductible, unless the survivor is the

for exemption to the extent the employe benefit plan was employer funded provided the

spouse. If the spouse survives, the total amount can be deducted and the death benefit

payment must be included as ordinary income for federal income tax purposes and the

payment need not be reported as an asset.

recipient irrevocably waives for federal income tax purposes capital gains treatment or

10 year income averaging.

Part 5 - Line 4, Page 2 (Administration Expenses)

Report the expenses of administration which include expenses incurred in the termina-

Benefits from any employe retirement plan of the United States, State of Wisconsin or

tion of a joint tenancy such as attorney fees, personal representative fees, appraisal

Wisconsin municipality are completely exempt and need not be reported. Also exempt

fees and publication fees to the extent such expenses HAVE NOT BEEN DE-

are group life insurance proceeds paid from the retirement plan of the State of Wisconsin

(effective for deaths on or after January 1, 1982).

DUCTED OR WILL NOT BE DEDUCTED FOR WISCONSIN INCOME

TAX PURPOSES. CAUTION: For deaths prior to August 1, 1987, no deduction

is permitted if the administration expenses have been or will be deducted on the federal

If the decedent made gifts within two years prior to death, the gifts are generally consid-

income tax return.

ered to have been made in contemplation of death even though the decedent may have

appeared healthy immediately prior to death. Such gifts are subject to the Wisconsin

inheritance tax. If gifts were made within two years prior to death, attach a copy of the

Part 5 - Line 5, Page 2 (Total Deductions)

If line 5 exceeds line 1, Part 1, the excess may be applied against the distributive share

death certificate to Form 101A.

of the distributee who actually paid the expense or is obligated to make payment.

Part 1 - Line 6, Page 1 (Insurance Proceeds)

Enter the total of life insurance proceeds paid to all named beneficiaries on the death

of the decedent. For deaths prior to July 1, 1979, deduct a $10,000 exclusion and enter

COMPUTATION OF TAX

the remaining amount. (No exclusion is available for deaths on or after July 1, 1979.)

The $10,000 exclusion is the maximum exclusion allowed regardless of the total insur-

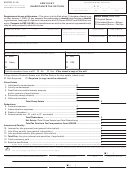

Part 2 - Page 1

ance proceeds paid beneficiaries or the number of insurance policies or beneficiaries.

Enter the name of the distributee in column 1 and the distributee’s social security number

Insurance proceeds payable to the estate are not eligible for this exclusion and should

in column 2. (Failure to include the social security number of all distributees may delay

be entered in Part 3. If there is more than one insurance policy on the decedent’s life, a

the processing of this return.) In column 3, report the amount of the decedent’s Wisconsin

schedule should be attached listing each policy, the names of the beneficiaries and the

taxable estate (Part 1, line 8) each distributee will receive.

amount of benefits payble to each beneficiary.

In column 4, enter the distributee’s relationship to the decedent.

Part 1 - Line 7, Page 1 (Other Property)

Enter the value of and itemize all other property that decedent held an interest in at date

Compute the tax for column 5 using the tax rates from the table below. In computing the

of death. Report benefits paid to a beneficiary under an employe benefit plan, including

tax due on each distributee’s share first deduct the exemptions from the lowest bracket(s).

retirement payments not indicated below as exempt. Any amount accumulated as a

Compute the tax on the balance remaining in each bracket after the available exemptions

result of the employer’s contributions to a federally qualified plan is exempt. The person

have been deducted. Enter the tax computed in column 5.

administering the program can furnish information on this. For deaths occurring on or

after January 1, 1978 but before January 1, 1979, benefits payable in a lump-sum are

BEGINNING WITH DATES OF DEATH IN 1988, THE INHERITANCE

fully includible in the decedent’s estate regardless of who contributed to the plan. For

TAX IS BEING PHASED OUT OVER A FIVE-YEAR PERIOD. USE

deaths occurring on or after January 1, 1979, a lump-sum payment will again qualify

SCHEDULE TC BELOW TO COMPUTE THE AMOUNT DUE.

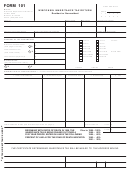

Wisconsin Inheritance Tax Exemptions and Rates For Form 101A

Balance

$25,000

$50,000

$100,000

Personal

of

to

to

to

Relationship to Decedent

Exemptions

$25,000

$50,000

$100,000

$200,000

A

Spouse (deaths on or after January 1, 1978 but before July 1, 1979)

1

$

50,000

3.75%

5.0%

Spouse (deaths on or after July 1, 1979 but before July 1, 1982)

250,000

Spouse (deaths on or after July 1, 1982) All property received is exempt

Lineal issue (children, grandchildren), lineal ancestor (parents, grandparents), wife or

A

2

widow of a son, husband or widower of a daughter, adopted or mutually acknowledged

child, or mutually acknowledged parent

Deaths on or after January 1, 1978 but before July 1, 1979

4,000

2.5%

5.0%

7.5%

10.0%

Deaths on or after July 1, 1979 but before April 13, 1984

10,000

Deaths on or after April 13, 1984 but before July 1, 1985

25,000

Deaths on or after July 1, 1985

50,000

15.0%

B

Brother, sister, or descendant of brother or sister (niece, grandnephew, etc.)

1,000

5.0%

10.0%

20.0%

*

*

C

Brother or sister of a father or mother, or a descendant of a brother or sister

1,000

7.5%

15.0%

22.5%

30.0%

*

*

D

All others regardless of relationship to the decedent

500

10.0%

20.0%

30.0%

30.0%

The personal exemption is applied against the lowest bracket.

The tax cannot exceed 20% of the value of the property transferred to any distributee.

*For deaths on or after January 1, 1986, these tax rates are 20% instead of the rates shown.

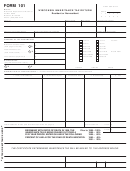

Schedule TC — Tax Computation

1987 and

For Deaths in

1988

1989

1990

1991

Prior

1. Tax from line 11, Page 1 ..................................................................................

2. Percentage of Tax Payable ..............................................................................

100%

80%

60%

40%

20%

3. Multiply amount on line 1 by rate on line 2. (Enter here and on line 12,

of Page 1 of Form 101A...................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4