DTE 131

R.C. § 133.06

Rev. 7/11

Instructions for Completing Form

Page 2

General Instructions

Line 4 Enter total of lines 3(a) to 3(t).

This form and the other information required by Ohio Depart-

Line 5 Subtract line 4 from line 2 and enter the difference

ment of Taxation DTE Bulletin 8 must be submitted to the tax

here.

commissioner and to the superintendent of public instruction

Line 6 Enter any bond retirement fund balance applicable

for their consents, only if the percentage entered on line 8

to the principal of the securities in line 5.

exceeds 4.00%. File this form and the other required informa-

tion with the commissioner and superintendent at least 120

Line 7 Subtract line 6 from line 5 and enter the difference

days before the election at which the proposed issue will be

here.

submitted at the following addresses: Ohio Department of

st

Taxation, Tax Equalization Division, 21

Floor, 30 East Broad

Line 8 Divide line 7 by line 1 and enter the quotient here

Street, Columbus, Ohio 43215-3414 AND Ohio Department

as a percentage. If this percentage is greater than

of Education, Attn: Sonja Hunter, Center for School Options

4.00%, consents of the tax commissioner and the

and Finance, MS 710, 25 South Front Street, Columbus,

superintendent of public instruction are required

Ohio 43215-4183.

to submit the issue to the vote of the electorate,

unless the proposed issue is to raise the school

Line Instructions

district portion of the basic project cost and other

required costs or certain optional costs of a class-

Line 1 Enter total tax valuation from the real and public

room facilities project under Chapter 3318, in which

utility property tax list that was most recently certi-

case no consents are required for that issue (§

fi ed for collection. See Bulletin 8 for a more detailed

133.06(I)). If this percentage is greater than 9.00%,

explanation of the exclusions from tax valuation and

the school district must also acquire the approval

how to obtain them. Include tax valuations from all

of the superintendent as a special needs district to

counties in which the school district is located. This

place the proposed issue on the ballot, unless the

total amount should agree with total on DTE form(s)

proposed issue is to raise the school district portion

13 for that year, if available, and is not necessar-

of the basic project cost and other required costs or

ily the same as that used by the county auditor to

certain optional costs of a classroom facilities project

estimate the millage rate for the ballot.

under Chapter 3318, in which case lines 9 and 10

need not be completed (§ 133.06(I)). See Item 6 of

Line 2 Enter total principal amount of outstanding securi-

Bulletin 8 for more details on the classroom facilities’

ties of the school district, including any amount ap-

excepted debt.

portioned to the district and excluding any amount

apportioned to another school district, as a result

Line 9 Enter superintendent of public instruction’s projected

of the acquisition or loss of territory (§ 133.04(A)).

tax valuation under § 133.06(E)(4).

Exclude any securities to be retired by the proposed

issue (§ 133.34(D)). Always include classroom fa-

Line 10 Divide line 7 by line 9 and enter the quotient here as

cilities securities, but note the instruction to line 8.

a percentage. If this percentage exceeds 12.00%,

Do not include any obligations of a lease-purchase

the commissioner and superintendent cannot con-

or similar agreement (§§ 133.01(GG)(2), (KK) and

sent to the submission of the proposed issue on the

3313.375). State amount of proposed issue and

ballot.

include it in the total.

Line 3 Enter exempt securities on the appropriate lines.

Enter other amounts on (t) and state Revised Code

section(s).

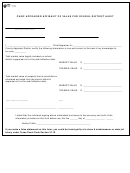

Please Print or Type the Following Information for:

Bond Counsel

School District

Attorney

Treasurer

Firm

School

Address

Address

City/state

ZIP

City/state

ZIP

Telephone number

Telephone number

FAX number

FAX number

E-mail

E-mail

1

1 2

2