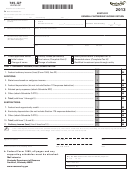

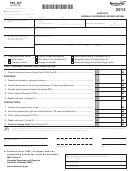

RI-1065

Federal employer identification number

Name

page 3

Schedule I - Federal Taxable Income

Enter amount of federal taxable income for the year that ended

2013

2012

2011

2010

2009

Schedule J - Apportionment

COLUMN A

COLUMN B

RI

EVERYWHERE

1a.

Average net

1. a. Inventory ....................................................................................

1b.

book value

b. Depreciable assets ....................................................................

1c.

c. Land...........................................................................................

1d.

d. Rent (8 times annual net rental rate).........................................

1e.

e. Total ...........................................................................................

1f.

_._ _ _ _ _ _

f. Ratio in Rhode Island. Line 1e, column A divided by line 1e, column B...........................................................................

Receipts

2. a. Gross receipts - Rhode Island Sales.........................................

2a.

Gross receipts - Sales Under 44-11-14 (a) (2) (i) (B)...............

2b.

b. Dividends ...................................................................................

2c.

c. Interest........................................................................................

2d.

d. Rents ..........................................................................................

2e.

e. Royalties .....................................................................................

2f.

f. Net capital gains .........................................................................

2g.

g. Ordinary income .........................................................................

2h.

h. Other income ..............................................................................

2i.

i. Income exempt from federal taxation .........................................

2j.

j. Total ............................................................................................

k. Ratio in Rhode Island. Line 2j, column A divided by line 2j, column B.............................................................................

_._ _ _ _ _ _

2k.

Salaries

3. a. Salaries and wages paid or incurred - (see instructions) ..........

3a.

b. Ratio in Rhode Island. Line 3a, column A divided by line 3a, column B...........................................................................

3b.

_._ _ _ _ _ _

Ratio

4 Total of Rhode Island Ratios shown on lines 1f, 2k and 3b ...................................................................................................

4.

_._ _ _ _ _ _

5. Apportionment Ratio. Line 4 divided by 3 or by the number of ratios used. Enter here and on page 1, schedule A, line 7..

5.

_._ _ _ _ _ _

THIS RETURN WILL NOT BE COMPLETE UNLESS ALL REQUIRED SCHEDULES FROM APPLICABLE US FORMS ARE ATTACHED

1

1 2

2 3

3