Property Tax Credit Claim - 2012 Page 3

ADVERTISEMENT

Helpful Hint

What’s Inside?

If you anticipate receiving any 1099 or W-2

income, please wait to file this claim until all

Am I Eligible?

2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

statements are received. Filing too early may

result in a balance due.

Do I Have the Correct Tax Book?

3

. . . . . . . . . . . . .

Important Filing Information

3–4

. . . . . . . . . . . . . . . .

Information to Complete Form MO-PTC

4–7

TO OBTAIN FORMS

. . . .

Refund Debit Card

7, 16

. . . . . . . . . . . . . . . . . . . . . . . . .

Visit

Information to Complete Form MO-CRP

8

. . . . . .

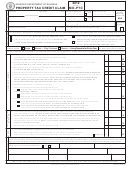

Form MO-PTC

9, 11

**IMPORTANT FILING

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form MO-CRP

10, 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

INFORMATION**

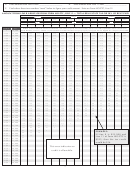

2012 Property Tax Credit Chart

13–15

. . . . . . . . . .

This information is for guidance only

Tax Assistance Centers

16

. . . . . . . . . . . . . . . . . . . . . . . .

and does not state the complete law.

WHEN TO FILE CLAIM

DO I HAVE THE CORRECT TAX BOOK?

The 2012 Form MO-PTC is due April 15, 2013, but

you may file up to three years from the due date and

You MAY USE this tax book to file your 2012 Form

still receive your credit.

MO-PTC, Property Tax Credit Claim if you meet

the eligibility requirements on page 2 and are not

WHERE TO MAIL CLAIM

required to file an individual income tax return.

Mail your completed Form MO-PTC and all

You cannot use this book if you were required to file

attachments to:

Department of Revenue

a federal return and you were a:

P.O. Box 2800

• R esident of Missouri and you had Missouri

Jefferson City, MO 65105-2800

adjusted gross income of $1,200 or more;

FILING FOR DECEASED

• N onresident of Missouri and had income of $600

INDIVIDUALS

or more from Missouri sources; or

• R esident or nonresident with Missouri withholding

If an individual passed away in 2012, a claim may

and you want to file an individual income tax

be filed by the surviving spouse if the filing status is

re t urn to claim a refund of your withholding.

“married filing combined” and all other qualifications

I f you have any negative income, you can not use this

are met. If there is no surviving spouse, the estate may

form.

file the claim.

If you meet any of the above qualifications, you

A copy of the death certificate must be attached and

cannot file the Form MO-PTC. You must file a

if the check is to be issued in another name, a Federal

Mis s ouri income tax return and attach Form MO-PTS

Form 1310 must also accompany the claim. To obtain

if you qualify for a property tax credit. See informa-

Federal Form 1310, go to

tion in the next column to obtain the correct form

Any existing POA pending with the Department of

(Form MO-1040 or Form MO-1040P) to file and

Revenue is terminated when the death of the taxpayer

claim your Property Tax Credit.

is made known to the Department. A new POA

Exception: You are not required to file a Missouri

(Form 2827) is required after death of the taxpayer

in c ome tax return if your standard deduction plus

before any party may discuss the taxpayer’s debt with

your personal exemption meet or ex c eed your

the Department staff.

Missouri adjusted gross income.

If you are a nonresident alien, go to our web site

at for

information.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16