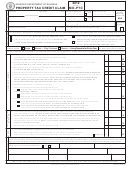

Property Tax Credit Claim - 2012 Page 7

ADVERTISEMENT

CREDITS

LINE 10 — RENT YOUR HOME

Complete one Form MO-CRP, Certification of

LINE 12 — PROPERTY TAX CREDIT

Rent Paid, for each rented home (including mobile

home or lot) you occupied during 2012. The Form

Apply amounts from Form MO-PTC, Lines 8 and 11 to

MO-CRP is on the back of the Form MO-PTC and

the Property Tax Credit Chart on pages 13 through 15

instructions are on page 8.

to determine the amount of your property tax credit.

Add the totals from Line 9 on all Forms MO-CRP

See Helpful Hint below. To receive your refund on

completed and enter the amount on Line 10, or $750,

a Visa debit card, select the debit card box on Line

whichever is less. Attach rent receipt(s) or a signed

12. For more information on Missouri’s refund debit

statement from your landlord for any rent you are

card, please visit our website at

claiming along with Form MO-CRP. Copies of

If you have another income tax or property tax credit

cancelled checks (front and back) will be accepted if

liability, this property tax credit may be applied to

your landlord will not provide rent receipts or a

that liability in accordance with Section 143.782,

statement.

RSMo. You will be notified if your credit is offset

You cannot claim returned check fees, late fees,

against any debts.

security and cleaning deposits, or any other deposit.

Helpful Hint

If you have the same address as your landlord, please

verify the number of occupants and living units.

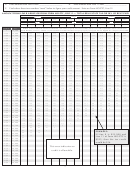

Your property tax credit is figured by comparing your

total income received to 20 percent of your net rent

paid or real estate tax paid. To make the comparison

Helpful Hints

and determine your credit, use the 2012 Property

• If you receive low income housing assistance the

Tax Credit Chart on pages 13 through 15. Lines are

rent you claim may not exceed 40 percent of your

provided on the chart to help you figure this amount.

income. Please claim only the amount of rent you

Example: Ruth paid $1,200 in real estate tax and

pay or your refund will be delayed or denied.

her total household income was $15,000. Ruth will

• I f your gross rent paid exceeds your household

apply her tax paid and her total household income

in c ome, you must attach a detailed statement

to the chart to figure out her credit amount. Even

explaining how the additional rent was paid or the

though Ruth paid $1,200 in real estate tax, she is

claim will be denied.

only allowed to take a credit of $1,100. Ruth will use

$1,100 as tax paid and her total household income of

• U tilities (air conditioning, gas, electric, late fees,

$15,000 to make the comparison. When using the

deposits, etc.) are not included.

chart, Ruth finds where $15,000 and $1,100 “meet”

• N ursing Homes — You must deduct personal

to figure her credit. The two numbers “meet” on the

allowances (clothing, hair stylists, etc.) prior to

chart where the credit amount is $1,059. Ruth will

calculating your rent.

get a $1,059 credit for the real estate tax she paid.

l

11 — t

r

e

INe

otal

eal

state

SIGN CLAIM

t

/ r

p

ax

eNt

aId

You must sign your Form MO-PTC. Both spouses must

sign a combined claim. If you use a paid preparer,

Add amounts from Form MO-PTC, Lines 9 and 10

the preparer must also sign the claim. If you wish

and enter amount on Line 11, or $1,100, whichever

to authorize the Director of Revenue, or delegate, to

is less.

discuss your tax information with your preparer

or any member of your preparer’s firm, indicate

Example: Ester owns her home for three months and

by checking the “yes” box above the signature line.

pays $100 in property taxes. For nine months she

Important: If the Form MO-PTC is being filed on

rents an apartment and pays $4,000 in rent.

behalf of a claimant by a nursing home or residential

The amount on Line 9 of the MO-CRP is $800

care facility, a statement to that effect from the claim-

($4,000 x 20%). Form MO-PTC, Line 9 is $100, Line

ant’s legal guardian or power of attorney must be

10 is $750, and Line 11 is $850. The $800 for rent

attached to the Form MO-PTC.

is limited to $750 on Line 10.

MAIL CLAIM

Send your claim and all attachments to: Department

of Revenue, P.O. Box 2800, Jefferson City, MO

65105-2800.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16