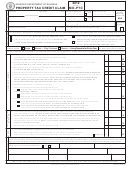

Property Tax Credit Claim - 2012 Page 6

ADVERTISEMENT

Attach a copy of Forms SSA-1099, a letter from the

Do not include special assessments (sewer lateral),

Social Security Ad min is tra tion, a letter from Social

penalties, service charges, and interest listed on your

Services that includes the total amount of assistance

tax receipt. You can only claim the taxes on your

received, and Em ploy ment Security 1099, if applicable.

primary residence that you occupy. Secondary homes

are not eligible for the credit.

Helpful Hints

If you submit more than one receipt from a city or

• S upplemental security income (SSI) is paid by the

county for your residence, please submit a letter of

Social Security Administration. You have to request

explanation.

an SSI form indicating total benefits received from

Your home or dwelling is the place in which you

your local social security office. The form should

reside in Missouri, whether owned or rented, and

be stamped or signed by the Social Security

the surrounding land, not to exceed five acres, as

Administration. If you have minor children who

is reasonably necessary for use of the dwelling as a

receive SSI benefits, the children do not qualify for

home. A home may be part of a larger unit such as

a credit. However, if you qualify for a credit you

must include the children’s SSI benefits on Line 5.

a farm or building partly rented or used for business.

• I f you receive temporary assistance from the

If you share a home, report only the portion of real

Children’s Division (CD) or the Family Support

estate tax that was actually paid by you. If you sold or

Division (FSD), you must include all cash benefits

purchased your home during the year, attach a copy

received for your entire household. The Department

of the seller’s/buyer’s agreement to your claim.

of Revenue verifies this information and failure to

include total benefits may delay your refund.

Helpful Hint

Real estate tax paid for a prior year cannot be claimed

LINE 7 — FILING STATUS

on this form. To claim real estate taxes for a prior

year, you must file a claim for that year.

DEDUCTION

Use your filing status to determine the deduction

If your home or farm has more than five acres or you

amount that will be entered on Line 7. If your filing

own a mobile home and it is classified as personal

status is Single or Married Living Separate, you will

property, a Form 948 Assessors Certification must

enter $0 on Line 7.

be attached with a copy of your paid personal or

If your filing status is Married and Filing Combined,

real property tax receipt. If you own a mobile home

see below to determine the amount you will enter on

and it is classified as real property, a Form 948 isn’t

Line 7.

needed. In such cases, you can claim property tax for

• I f you OWNED and OCCUPIED your home for the

the mobile home and rent if applicable, for the lot. A

ENTIRE YEAR, enter $4,000 on Line 7.

credit will not be allowed for vehicles listed on the

• I f you RENTED or did not own your home for the

personal property tax receipt.

ENTIRE YEAR, enter $2,000 on Line 7.

If you use your home for business purposes, the

percentage of your home that is used for business

LINE 8 — NET HOUSEHOLD INCOME

purposes, must be subtracted from your real estate

Subtract Line 7 from Line 6 and enter amount on Line 8.

taxes paid. If you need to use a Form 948 to

See below to make sure you are eligible for the credit.

calculate the amount of real estate tax, you must

subtract the percentage of your home that is used for

• I f you OWNED AND OCCUPIED your home for

business purposes from the allowable real estate taxes

the ENTIRE YEAR, the amount you enter on Line 8

paid calculated on the Form 948.

cannot exceed $30,000. If the amount of your net

household income on Line 8 is above $30,000,

Example: Ruth has 10 acres surrounding her house.

you are not eligible for the credit.

She needs to use a Form 948, because she is only

• I f you RENTED or did not own and occupy your

entitled to receive credit for 5 acres. By her calcula-

home for the ENTIRE YEAR, the amount you enter

tions, she enters $500 on Form 948, Line 6. Ruth

on Line 8 cannot exceed $27,500. If the amount

also uses 15 percent of her house for her business.

of your net household income on Line 8 is above

She will multiply $500 by 85 percent and put this

$27,500, you are not eligible for the credit.

figure ($425) on Form MO-PTC, Line 9.

LINE 9 — OWN YOUR HOME

Helpful Hint

If you own your home and other adults (other

If you owned and occupied your home, include the

than your spouse) live there and pay rent, the

amount of tax you paid on your 2012 real estate

rent must be claimed as income.

tax receipt(s) only, or $1,100, whichever is less.

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

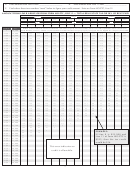

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16