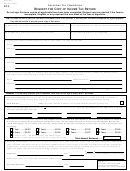

3944, page 2

8.

Will those certifications and the settlement tax roll be transmitted to the County Treasurer as required

Yes

No

by Section 55 of the General Property Tax Act?

9.

Will the certification by the assessor, attached to the settlement tax roll, include documentation that

Yes

No

authorizes and reports all changes in the precollection tax roll? (Submit samples.)

PART 4: PROCEDURES AND REQUIREMENTS

Yes

No

10.

Will the treasurer of the local tax collecting unit prepare and maintain a journal of individual

collections, totaled and reconciled to the amount of actual daily collections?

Will payment of each tax be posted to the computerized database system using a transaction or

11.

Yes

No

receipt number with the payment date? (A posting on the computerized database system is

considered the entry of the fact and date of payment in an indelible manner on the tax roll as required

by section 46(2) of the General Property Tax Act.)

12.

Does the computerized database system have internal and external security procedures sufficient to

Yes

No

assure the integrity of the system? (Attach a description of the procedures used by each local

unit.)

13.

Is the local tax collection unit capable of making available a posted computer printed tax roll at any

Yes

No

time?

14.

Does the system have a "read only" terminal or other procedure for public viewing of the posted tax

Yes

No

roll? (If other procedure is used, describe it and give an example.)

PART 5: CERTIFICATION

I, ____________________________, Treasurer of _______________________________ County, declare that I have examined

this application and have become familiar with the tax collection system described here for the local units certified below. To the

best of my knowledge, this system meets the requirements of section 42a of the General Property Tax Act and is compatible with

the system or systems currently in use by our office.

Signature of County Treasurer

County of

Date:

Continue on page 3

1

1 2

2 3

3 4

4