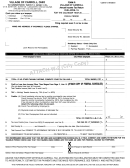

Form Alc 105 - Wine Tax Return Page 2

Download a blank fillable Form Alc 105 - Wine Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Alc 105 - Wine Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

INSTRUCTIONS

General:

There is levied upon the sale and distribution of wine produced in Tennessee a tax on each gallon.

Due Date:

The return along with the appropriate payment is due to be filed on or before the 15th day of the month following the period

covered.

Taxpayer/

Tax Preparer's

You must sign and date your return. Paid preparers, (accountants, attorneys etc.) must also sign the return.

Signature:

Filing:

Make your check payable to the Tennessee Department of Revenue for the amount shown on Line 6 of the return and mail with

the return to: Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville,

Tennessee 37242. Payment of the tax by Electronic Funds Transfer (EFT) does not relieve you of filing a timely tax return.

Amended Return:

If this is an amended return, please indicate "filing period" and check the appropriate box on the front of this form.

COMPUTATION OF TAX

Line 1. Taxable sales in gallons.

Line 2. Tax Due (Multiply Line 1 by tax rate).

Line 3. Credit: enter outstanding credit amount from Department of Revenue notice(s).

Line 4. Penalty: If filed late, penalty is computed at 5% of tax due (Line 2 minus any credit on Line 3) for each 30-day period or portion thereof that

the return is late. Maximum penalty is not to exceed 25% of the tax due; minimum penalty is $15 regardless of amount of tax due or whether

there is any tax due.

Line 5. Interest: If filed late, interest is computed at the current rate on the tax (Line 2 minus Line 3 credit, if applicable) from the due date to date

paid.

Line 6. Total amount remitted: Add lines 2, 4, and 5; subtract Line 3 (if applicable).

SCHEDULE A - WORKSHEET

For additional information, contact the Taxpayer Services Division in one of

our Department of Revenue Offices:

WINE TAX RETURN:

(Transfer amounts to Schedule A below)

Chattanooga

Knoxville

CARRY GALLONAGE FIGURES TO FOUR DECIMAL PLACES

(423) 634-6266

(865) 594-6100

Suite 350

Suite 300

State Office Building

7175 Strawberry Plains Pike

1. Number gallons on hand/Beginning of Period .......

_______________________

540 McCallie Avenue

Memphis

Jackson

(901) 213-1400

2. Add: Number of gallons produced during period ...

_______________________

(731) 423-5747

3150 Appling Road

Suite 340

Lowell Thomas Building

3. Total gallons available .............................................

_______________________

225 Martin Luther King Blvd.

Nashville

Johnson City

(615) 253-0600

4. Less: Number of gallons on hand end of period ...

_______________________

(423) 854-5321

Andrew Jackson Building

204 High Point Drive

500 Deaderick Street

5. Number of gallons sold ..............................................

_______________________

Tennessee residents can also call our statewide toll free number at

6. Less: Adjustment (List sales to wholesalers plus the

1-800-342-1003. Out-of-state callers must dial (615) 253-0600.

bulk exchange) ............................................................

_______________________

If your account number is not preprinted on the front of the

return, enter your federal employer identification number

(FEIN) or social security number (SSN) in the spaces below:

7. Taxable Sales in gallons (Subtract Line 6 from Line 5)

_______________________

Check appropriate box

Schedule A

and fill in number below:

FEIN or SSN

Transfer amount on Line 7 below to Line 1 of worksheet on the front

1. Number gallons on hand/Beginning of Period .......

_______________________

2. Add: Number of gallons produced during period ...

_______________________

3. Total gallons available .............................................

_______________________

Under penalties of perjury, I declare that I have examined this report, and to the best of my

4. Less: Number of gallons on hand end of period ...

_______________________

knowledge and belief, it is true, correct, and complete.

5. Number of gallons sold ..............................................

_______________________

Taxpayer's Signature

Date

6. Less: Adjustment (List sales to wholesalers plus the

bulk exchange) ............................................................

_______________________

Date

Signature of Preparer other than Taxpayer

7. Taxable Sales in gallons (Subtract Line 6 from Line 5)

_______________________

Phone Number

Tax Preparer's Address

INTERNET (3-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2