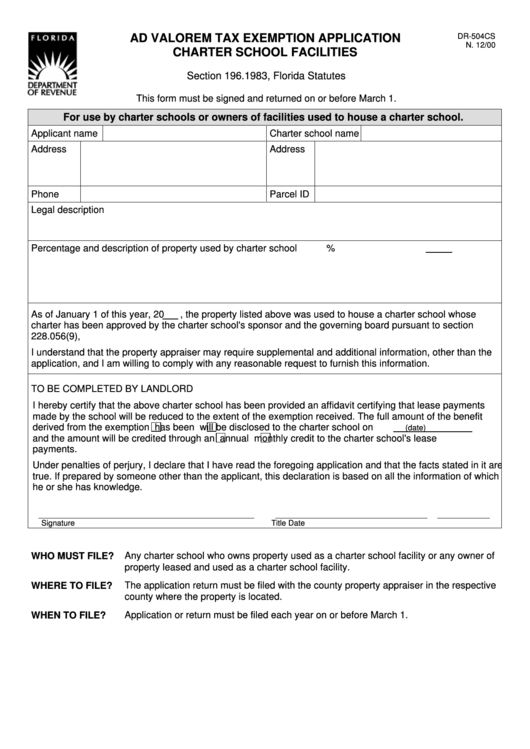

AD VALOREM TAX EXEMPTION APPLICATION

DR-504CS

N. 12/00

CHARTER SCHOOL FACILITIES

Section 196.1983, Florida Statutes

This form must be signed and returned on or before March 1.

For use by charter schools or owners of facilities used to house a charter school.

Applicant name

Charter school name

Address

Address

Phone

Parcel ID

Legal description

Percentage and description of property used by charter school

%

As of January 1 of this year, 20

, the property listed above was used to house a charter school whose

charter has been approved by the charter school's sponsor and the governing board pursuant to section

228.056(9), F.S.

I understand that the property appraiser may require supplemental and additional information, other than the

application, and I am willing to comply with any reasonable request to furnish this information.

TO BE COMPLETED BY LANDLORD

I hereby certify that the above charter school has been provided an affidavit certifying that lease payments

made by the school will be reduced to the extent of the exemption received. The full amount of the benefit

derived from the exemption

has been

will be disclosed to the charter school on

(date)

and the amount will be credited through an

annual

monthly credit to the charter school's lease

payments.

Under penalties of perjury, I declare that I have read the foregoing application and that the facts stated in it are

true. If prepared by someone other than the applicant, this declaration is based on all the information of which

he or she has knowledge.

Signature

Title

Date

WHO MUST FILE?

Any charter school who owns property used as a charter school facility or any owner of

property leased and used as a charter school facility.

WHERE TO FILE?

The application return must be filed with the county property appraiser in the respective

county where the property is located.

WHEN TO FILE?

Application or return must be filed each year on or before March 1.

1

1