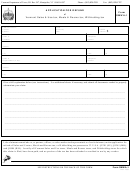

Form Smwa-1 - Application For Refund Of Vermont Sales & Use Tax, Meals & Rooms Tax, Withholding Tax Page 2

ADVERTISEMENT

INSTRUCTIONS

TIME LIMITATION

Refunds of Sales & Use tax, Meals & Rooms tax, and Withholding tax may be requested within three years from

the date the original return was due.

Vendors who write off uncollectible accounts on which sales tax had been reported may claim refunds within two

years from the date the account is charged off their books.

EXPLANATION

Attach a full explanation which will allow the examiner to understand why the tax payment was in error. In the

case of uncollectible accounts, give the reason (e.g. bankruptcy, disputed charge, etc.) that the account is uncol-

lectible.

DOCUMENTATION

Enclose copies of invoices, exemption certificates, credit memoranda, etc., which document the erroneous pay-

ment. If the items included in the claim are voluminous, a columnar worksheet or schedule should be submitted

showing all pertinent information from these documents. A typical schedule would show: identifying information

(names, dates, invoice numbers, etc.), taxable and non-taxable amounts, Vermont tax charged or withheld, and

description of the transaction. Include copies of representative documents, including at least the five most

recent transactions. Refunds for sales tax must show proof that the tax has been refunded to customers.

EXAMPLES

If the claim is for uncollectible accounts, show all transactions on the account beginning with the original charge.

Show: sales amount, amount of sales tax charged, amount of any non-taxable charges, credits or debits applied to

the account.

If a claim is based on another tax paid (Motor Vehicle Purchase and Use, or Motor Fuels), include documentation

showing the other tax and the Vermont sales tax being paid on the same property.

Claims under 32 V.S.A. §9746 for credit for snowmobiles, motorboats, or vessels require copies of the invoice or

bill of sale showing the date, purchaser, address, and selling price of the property sold and similar documentation

plus proof of sales tax payment for the replacement property.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2