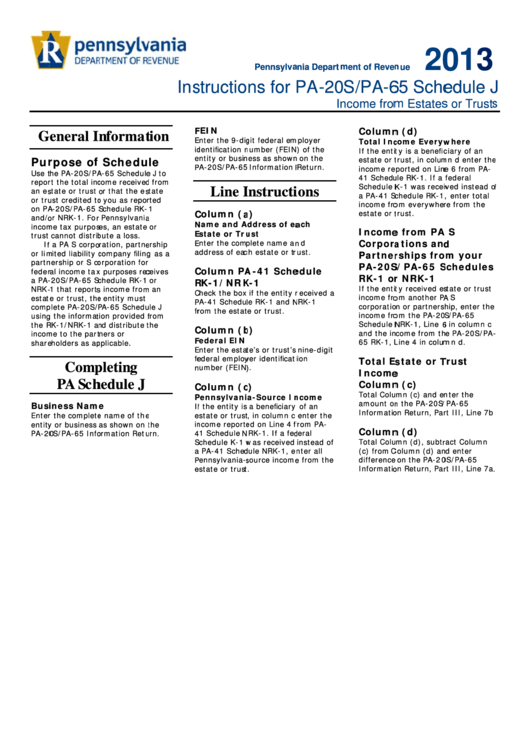

Instructions For Form Pa-20s/pa-65 - Schedule J - Estates And Trusts - 2013

ADVERTISEMENT

20

013

Pennsylva

ania Departm

ment of Reven

nue

Ins

structio

ns for P

PA-20S

S/PA-6

65 Sche

edule J

J

In

come from

m Estates

s or Trusts

s

F

FEIN

Column

n (d)

G

eneral In

nformat

tion

E

Enter the 9-dig

git federal em

mployer

Total Inc

come Everyw

where

id

dentification n

number (FEIN

) of the

If the entit

ty is a benefic

ciary of an

e

entity or busin

ness as shown

n on the

Pur

rpose of

f Schedu

le

estate or t

trust, in colum

mn d enter the

e

P

PA-20S/PA-65

Information R

Return.

income re

ported on Line

e 6 from PA-

Use t

the PA-20S/PA

A-65 Schedule

e J to

41 Schedu

ule RK-1. If a

federal

repor

rt the total inc

come received

d from

Schedule K

K-1 was receiv

ved instead o

f

an es

state or trust

or that the es

tate

Line I

Instructi

ions

a PA-41 Sc

chedule RK-1,

, enter total

or tru

ust credited to

o you as repor

rted

income fro

om everywher

re from the

on PA

A-20S/PA-65 S

Schedule RK-

1

C

Column (a

a)

estate or t

trust.

and/o

or NRK-1. For

r Pennsylvania

a

N

Name and A

ddress of ea

ach

incom

me tax purpos

ses, an estate

or

Income

e from PA

S

E

Estate or Tru

ust

trust

cannot distrib

bute a loss.

Corpora

ations and

d

E

Enter the com

plete name an

nd

If

f a PA S corpo

oration, partne

ership

a

address of eac

ch estate or tr

rust.

or lim

mited liability c

company filing

g as a

Partner

rships fro

m your

partn

nership or S co

orporation for

r

PA-20S

S/PA-65 S

Schedules

C

Column PA

A-41 Sche

edule

feder

ral income tax

x purposes rec

ceives

RK-1 or

r NRK-1

a PA-

-20S/PA-65 Sc

chedule RK-1

or

R

RK-1/NRK

K-1

If the entit

ty received es

state or trust

NRK-

-1 that reports

s income from

m an

C

Check the box

if the entity r

received a

income fro

om another PA

A S

estat

te or trust, the

e entity must

P

PA-41 Schedul

le RK-1 and N

NRK-1

corporatio

n or partnersh

hip, enter the

comp

plete PA-20S/P

PA-65 Schedu

ule J

fr

rom the estat

e or trust.

income fro

om the PA-20S

S/PA-65

using

g the informat

tion provided f

from

Schedule N

NRK-1, Line 6

6 in column c

the R

RK-1/NRK-1 an

nd distribute t

the

C

Column (b

b)

and the in

come from th

he PA-20S/PA-

-

incom

me to the part

tners or

F

Federal EIN

65 RK-1, L

Line 4 in colum

mn d.

share

eholders as ap

pplicable.

E

Enter the estat

te’s or trust’s

nine-digit

fe

ederal employ

yer identificati

ion

Total Es

state or T

Trust

Comp

pleting

n

number (FEIN)

).

Income

e

Column

n (c)

PA Sch

hedule J

C

Column (c

c)

Total Colu

mn (c) and en

nter the

P

Pennsylvani

a-Source In

ncome

amount on

n the PA-20S/

/PA-65

Bus

iness Nam

e

I

f the entity is

a beneficiary

y of an

Informatio

on Return, Par

rt III, Line 7b

.

Enter

r the complete

e name of the

e

e

estate or trust

, in column c

enter the

entity

y or business

as shown on

the

in

ncome reporte

ed on Line 4 f

from PA-

Column

n (d)

4

41 Schedule N

RK-1. If a fed

deral

PA-20

0S/PA-65 Info

ormation Retu

urn.

S

Schedule K-1 w

was received

instead of

Total Colu

mn (d), subtr

ract Column

a

a PA-41 Sched

dule NRK-1, en

nter all

(c) from C

Column (d) an

d enter

difference

on the PA-20

0S/PA-65

P

Pennsylvania-s

source income

e from the

Informatio

on Return, Par

rt III, Line 7a.

.

e

estate or trust

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1