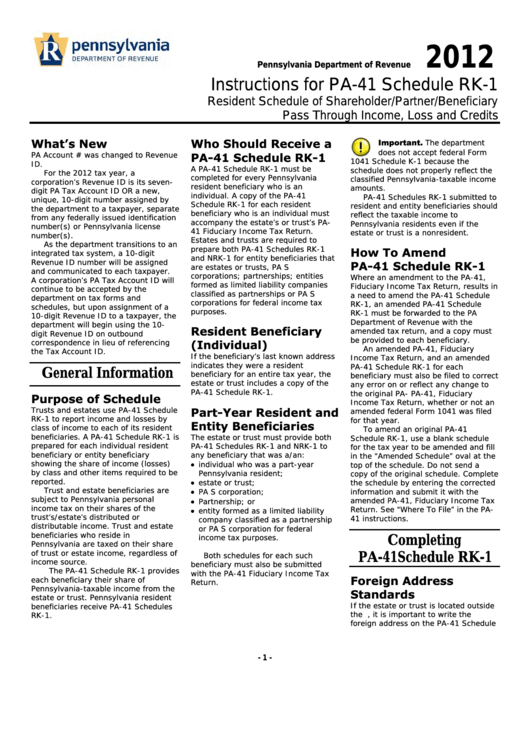

Instructions For Form Pa-41 - Schedule Rk-1 - Resident Schedule Of Shareholder/partner/beneficiary Pass Through Income, Loss And Credits - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule RK-1

Resident Schedule of Shareholder/Partner/Beneficiary

Pass Through Income, Loss and Credits

What’s New

Who Should Receive a

Important.

The department

does not accept federal Form

PA Account # was changed to Revenue

PA-41 Schedule RK-1

1041 Schedule K-1 because the

ID.

A PA-41 Schedule RK-1 must be

schedule does not properly reflect the

For the 2012 tax year, a

completed for every Pennsylvania

classified Pennsylvania-taxable income

corporation’s Revenue ID is its seven-

resident beneficiary who is an

amounts.

digit PA Tax Account ID OR a new,

individual. A copy of the PA-41

PA-41 Schedules RK-1 submitted to

unique, 10-digit number assigned by

Schedule RK-1 for each resident

resident and entity beneficiaries should

the department to a taxpayer, separate

beneficiary who is an individual must

reflect the taxable income to

from any federally issued identification

accompany the estate’s or trust’s PA-

Pennsylvania residents even if the

number(s) or Pennsylvania license

41 Fiduciary Income Tax Return.

estate or trust is a nonresident.

number(s).

Estates and trusts are required to

As the department transitions to an

prepare both PA-41 Schedules RK-1

How To Amend

integrated tax system, a 10-digit

and NRK-1 for entity beneficiaries that

Revenue ID number will be assigned

PA-41 Schedule RK-1

are estates or trusts, PA S

and communicated to each taxpayer.

corporations; partnerships; entities

Where an amendment to the PA-41,

A corporation’s PA Tax Account ID will

formed as limited liability companies

Fiduciary Income Tax Return, results in

continue to be accepted by the

classified as partnerships or PA S

a need to amend the PA-41 Schedule

department on tax forms and

corporations for federal income tax

RK-1, an amended PA-41 Schedule

schedules, but upon assignment of a

purposes.

RK-1 must be forwarded to the PA

10-digit Revenue ID to a taxpayer, the

Department of Revenue with the

department will begin using the 10-

Resident Beneficiary

amended tax return, and a copy must

digit Revenue ID on outbound

be provided to each beneficiary.

correspondence in lieu of referencing

(Individual)

An amended PA-41, Fiduciary

the Tax Account ID.

If the beneficiary’s last known address

Income Tax Return, and an amended

indicates they were a resident

PA-41 Schedule RK-1 for each

General Information

beneficiary for an entire tax year, the

beneficiary must also be filed to correct

estate or trust includes a copy of the

any error on or reflect any change to

PA-41 Schedule RK-1.

the original PA- PA-41, Fiduciary

Purpose of Schedule

Income Tax Return, whether or not an

Trusts and estates use PA-41 Schedule

Part-Year Resident and

amended federal Form 1041 was filed

RK-1 to report income and losses by

for that year.

Entity Beneficiaries

class of income to each of its resident

To amend an original PA-41

beneficiaries. A PA-41 Schedule RK-1 is

The estate or trust must provide both

Schedule RK-1, use a blank schedule

prepared for each individual resident

PA-41 Schedules RK-1 and NRK-1 to

for the tax year to be amended and fill

beneficiary or entity beneficiary

any beneficiary that was a/an:

in the “Amended Schedule” oval at the

showing the share of income (losses)

individual who was a part-year

top of the schedule. Do not send a

by class and other items required to be

Pennsylvania resident;

copy of the original schedule. Complete

reported.

estate or trust;

the schedule by entering the corrected

Trust and estate beneficiaries are

information and submit it with the

PA S corporation;

subject to Pennsylvania personal

amended PA-41, Fiduciary Income Tax

Partnership; or

income tax on their shares of the

Return. See “Where To File” in the PA-

entity formed as a limited liability

trust’s/estate’s distributed or

41 instructions.

company classified as a partnership

distributable income. Trust and estate

or PA S corporation for federal

beneficiaries who reside in

income tax purposes.

Completing

Pennsylvania are taxed on their share

of trust or estate income, regardless of

Both schedules for each such

PA-41Schedule RK-1

income source.

beneficiary must also be submitted

The PA-41 Schedule RK-1 provides

with the PA-41 Fiduciary Income Tax

Foreign Address

each beneficiary their share of

Return.

Pennsylvania-taxable income from the

Standards

estate or trust. Pennsylvania resident

If the estate or trust is located outside

beneficiaries receive PA-41 Schedules

the U.S., it is important to write the

RK-1.

foreign address on the PA-41 Schedule

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3