Instructions For Form Ct-001 - Wisconsin Cigarette Tax Refund Claim For Native American Tribes Page 2

ADVERTISEMENT

-2-

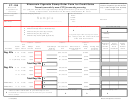

5. Number of cigarettes purchased (cartons or sticks).

ASSISTANCE

Our web site is available 24 hours a day, seven days a

6. Date paid by purchaser. Each invoice must be

week at From here you can:

marked paid, dated, and signed by the seller or

• Access My Tax Account

delivery person, unless you have received another

• Download forms, schedules, instructions, and

department approved method to show proof of

payment.

publications.

• View answers to frequently asked questions.

• Email us comments or request help.

7. Amount of Wisconsin cigarette tax paid.

Madison Office Location

RETURNED CIGARETTES/SHORT SHIPMENTS

2135 Rimrock Rd

A supplier credit invoice must be included for all cigarettes

Madison WI 53713

returned to the supplier or shorted in a shipment.

Mailing Address

RECORD KEEPING

Excise Tax Section 6-107

Keep a copy of this refund claim and all records supporting

Wisconsin Department of Revenue

the claim for a minimum of four years. Store the invoices in

PO Box 8900

a place that is easily accessible for review by department

Madison WI 53708-8900

representatives.

• Phone: (608) 266-8970

• Fax: (608) 261-7049

• E-mail: excise@revenue.wi.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2