Instructions For Form Rpd-41131 - Oil And Gas Taxes Summary Report

ADVERTISEMENT

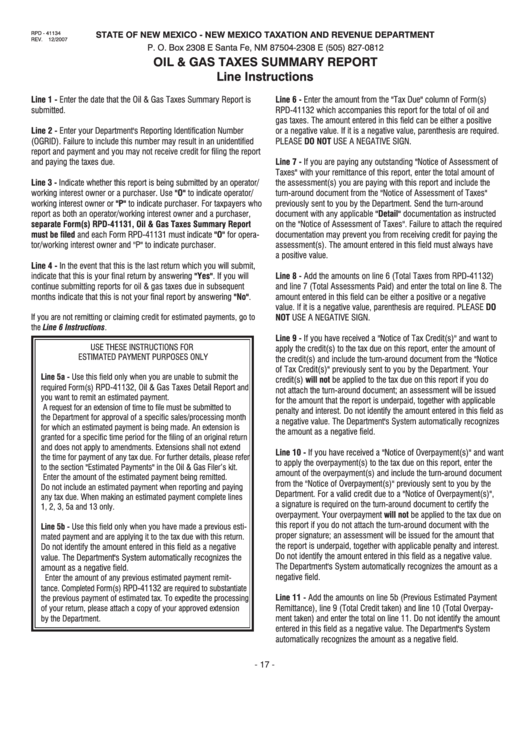

STATE OF NEW MEXICO - NEW MEXICO TAXATION AND REVENUE DEPARTMENT

RPD - 41134

REV.

12/2007

P . O. Box 2308 E Santa Fe, NM 87504-2308 E (505) 827-0812

OIL & GAS TAXES SUMMARY REPORT

Line Instructions

Line 1 - Enter the date that the Oil & Gas Taxes Summary Report is

Line 6 - Enter the amount from the "Tax Due" column of Form(s)

submitted.

RPD-41132 which accompanies this report for the total of oil and

gas taxes. The amount entered in this field can be either a positive

Line 2 - Enter your Department's Reporting Identification Number

or a negative value. If it is a negative value, parenthesis are required.

(OGRID). Failure to include this number may result in an unidentified

PLEASE DO NOT USE A NEGATIvE SIGN.

report and payment and you may not receive credit for filing the report

and paying the taxes due.

Line 7 - If you are paying any outstanding "Notice of Assessment of

Taxes" with your remittance of this report, enter the total amount of

Line 3 - Indicate whether this report is being submitted by an operator/

the assessment(s) you are paying with this report and include the

working interest owner or a purchaser. Use "O" to indicate operator/

turn-around document from the "Notice of Assessment of Taxes"

working interest owner or "P" to indicate purchaser. For taxpayers who

previously sent to you by the Department. Send the turn-around

report as both an operator/working interest owner and a purchaser,

document with any applicable "Detail" documentation as instructed

separate Form(s) RPD-41131, Oil & Gas Taxes Summary Report

on the "Notice of Assessment of Taxes". Failure to attach the required

must be filed and each Form RPD-41131 must indicate "O" for opera-

documentation may prevent you from receiving credit for paying the

tor/working interest owner and "P" to indicate purchaser.

assessment(s). The amount entered in this field must always have

a positive value.

Line 4 - In the event that this is the last return which you will submit,

indicate that this is your final return by answering "Yes". If you will

Line 8 - Add the amounts on line 6 (Total Taxes from RPD-41132)

continue submitting reports for oil & gas taxes due in subsequent

and line 7 (Total Assessments Paid) and enter the total on line 8. The

months indicate that this is not your final report by answering "No".

amount entered in this field can be either a positive or a negative

value. If it is a negative value, parenthesis are required. PLEASE DO

If you are not remitting or claiming credit for estimated payments, go to

NOT USE A NEGATIvE SIGN.

the Line 6 Instructions.

Line 9 - If you have received a "Notice of Tax Credit(s)" and want to

USE THESE INSTRUCTIONS FOR

apply the credit(s) to the tax due on this report, enter the amount of

ESTIMATED PAYMENT PURPOSES ONLY

the credit(s) and include the turn-around document from the "Notice

of Tax Credit(s)" previously sent to you by the Department. Your

Line 5a - Use this field only when you are unable to submit the

credit(s) will not be applied to the tax due on this report if you do

required Form(s) RPD-41132, Oil & Gas Taxes Detail Report and

not attach the turn-around document; an assessment will be issued

you want to remit an estimated payment.

for the amount that the report is underpaid, together with applicable

A request for an extension of time to file must be submitted to

penalty and interest. Do not identify the amount entered in this field as

the Department for approval of a specific sales/processing month

a negative value. The Department's System automatically recognizes

for which an estimated payment is being made. An extension is

the amount as a negative field.

granted for a specific time period for the filing of an original return

and does not apply to amendments. Extensions shall not extend

Line 10 - If you have received a "Notice of Overpayment(s)" and want

the time for payment of any tax due. For further details, please refer

to apply the overpayment(s) to the tax due on this report, enter the

to the section "Estimated Payments" in the Oil & Gas Filer’s kit.

amount of the overpayment(s) and include the turn-around document

Enter the amount of the estimated payment being remitted.

from the "Notice of Overpayment(s)" previously sent to you by the

Do not include an estimated payment when reporting and paying

Department. For a valid credit due to a "Notice of Overpayment(s)",

any tax due. When making an estimated payment complete lines

a signature is required on the turn-around document to certify the

1, 2, 3, 5a and 13 only.

overpayment. Your overpayment will not be applied to the tax due on

this report if you do not attach the turn-around document with the

Line 5b - Use this field only when you have made a previous esti-

proper signature; an assessment will be issued for the amount that

mated payment and are applying it to the tax due with this return.

the report is underpaid, together with applicable penalty and interest.

Do not identify the amount entered in this field as a negative

Do not identify the amount entered in this field as a negative value.

value. The Department's System automatically recognizes the

The Department's System automatically recognizes the amount as a

amount as a negative field.

negative field.

Enter the amount of any previous estimated payment remit-

tance. Completed Form(s) RPD-41132 are required to substantiate

Line 11 - Add the amounts on line 5b (Previous Estimated Payment

the previous payment of estimated tax. To expedite the processing

Remittance), line 9 (Total Credit taken) and line 10 (Total Overpay-

of your return, please attach a copy of your approved extension

by the Department.

ment taken) and enter the total on line 11. Do not identify the amount

entered in this field as a negative value. The Department's System

automatically recognizes the amount as a negative field.

- 17 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2