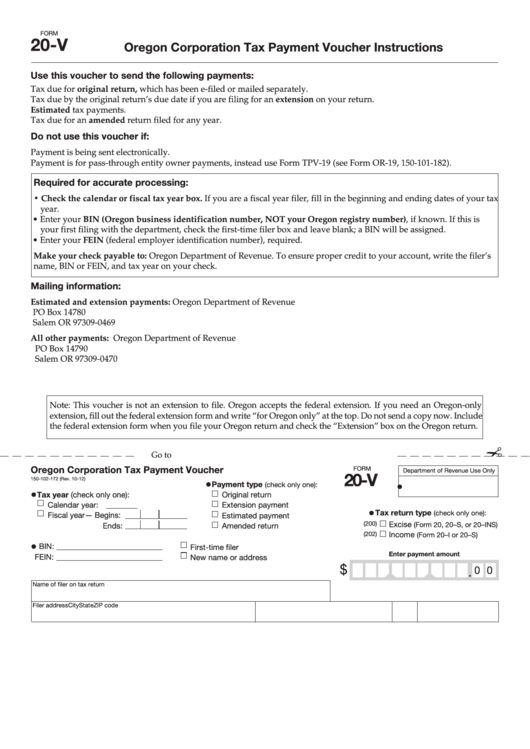

FORM

20-V

Oregon Corporation Tax Payment Voucher Instructions

Use this voucher to send the following payments:

Tax due for original return, which has been e-filed or mailed separately.

Tax due by the original return’s due date if you are filing for an extension on your return.

Estimated tax payments.

Tax due for an amended return filed for any year.

Do not use this voucher if:

Payment is being sent electronically.

Payment is for pass-through entity owner payments, instead use Form TPV-19 (see Form OR-19, 150-101-182).

Required for accurate processing:

• Check the calendar or fiscal tax year box. If you are a fiscal year filer, fill in the beginning and ending dates of your tax

year.

• Enter your BIN (Oregon business identification number, NOT your Oregon registry number), if known. If this is

your first filing with the department, check the first-time filer box and leave blank; a BIN will be assigned.

• Enter your FEIN (federal employer identification number), required.

Make your check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the filer’s

name, BIN or FEIN, and tax year on your check.

Mailing information:

Estimated and extension payments:

Oregon Department of Revenue

PO Box 14780

Salem OR 97309-0469

All other payments:

Oregon Department of Revenue

PO Box 14790

Salem OR 97309-0470

Note: This voucher is not an extension to file. Oregon accepts the federal extension. If you need an Oregon-only

extension, fill out the federal extension form and write “for Oregon only” at the top. Do not send a copy now. Include

the federal extension form when you file your Oregon return and check the “Extension” box on the Oregon return.

✁

Go to to print more vouchers.

Oregon Corporation Tax Payment Voucher

FORM

Department of Revenue Use Only

20-V

150-102-172 (Rev. 10-12)

•

Clear Form

•

Payment type

(check only one):

•

Tax year (check only one):

Original return

Calendar year:

Extension payment

•

Tax return type

(check only one):

Fiscal year— Begins:

Estimated payment

(200)

Excise

(Form 20, 20–S, or 20–INS)

Ends:

Amended return

Income

(202)

(Form 20–I or 20–S)

•

BIN:

First-time filer

Enter payment amount

FEIN:

New name or address

$

0 0

.

Name of filer on tax return

Filer address

City

State

ZIP code

1

1