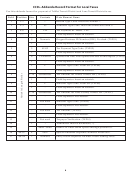

Field 3—Tax Payment ID. This field will always

Field 10—Tax Amount for Withholding (TXP07). The

be TXP.

amount to be posted to your Withholding account.

Do not insert a decimal point. The last two charac-

Field 4—Oregon Business Identification Number

ters are cents. Enter a 0 (zero) if payment does not

(BIN) (TXP01). A numeric field that uniquely iden-

include withholding.

tifies the taxpayer sending the payment. This num-

Field 12—Tax Amount for Workers’ Benefit Fund

ber is your Oregon Business Identification Number

(TXP09). The amount to be posted to your Workers’

(BIN). Its use is essential for your payment to be

Benefit Fund Assessment account. Do not insert a

properly posted. Don’t put the dash just before the

decimal point. The last two characters are cents. En-

last character in the field. For example: BIN 104532-6

ter a 0 (zero) if payment does not include Workers’

would be entered as 1045326.

Benefit Fund.

Field 5—Tax Type Code (TXP02). This field contains

Field 13—Taxpayer Verification (TXP10). The de-

the code for your tax payment. Enter 01101 for state

partment does not use this field.

tax payments.

Field 14—Terminator. A backslash (\) must be

Field 6—Quarter End Date (TXP03). This entry must

entered.

contain the quarter end date, using the year, month,

and last day of the month. For example: a payment

Field 15—Blank Fill. Enter blank spaces through po-

applicable to the quarter ending March 31, 2003 will

sition 83. The next field starts on position 84.

be entered as: 030331.

Field 16—Special Addenda Sequence Number. For

Fields 7, 9, and 11—Amount Type Code (TXP04,

the CCD+ format this entry will always be 0001.

TXP06, TXP08). These entries will always be an S

Field 17—Entry Detail Sequence Number. This num-

for the addenda record for payment of state payroll

ber is the same as the last seven digits of the trace

taxes.

number on the corresponding Entry Detail Record.

Field 8—Tax Amount for Unemployment (TXP05).

Field 1—Record Type Code. This field will always be

The amount to be posted to your Unemployment

a 7 for the CCD+ Addenda Record.

Insurance account. Do not insert a decimal point.

The last two characters are cents. Enter a 0 (zero) if

Field 2—Addenda Type Code. This field will always

payment does not include unemployment.

be a 05 for the CCD+ Addenda Record.

7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13