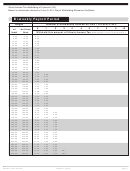

Booklet Il-700-T - Illinois Withholding Tax Tables Page 19

ADVERTISEMENT

Illinois Income Tax withholding at 5 percent (.05)

Based on allowances claimed on Form IL-W-4, Illinois Withholding Allowance Certificate.

Monthly Payroll Period

Wages

Number of allowances claimed on Line 1 of Form IL-W-4

0

1

2

3

4

5

6

7

8

9

10

at

but less

(Subtract $4.17 for each allowance

least

than

Withhold this amount of Illinois Income Tax

——

claimed on Line 2 of Form IL-W-4.)

0.00

10.00

0.25

10.00

20.00

0.75

20.00

30.00

1.25

30.00

40.00

1.75

40.00

50.00

2.25

50.00

60.00

2.75

60.00

70.00

3.25

70.00

80.00

3.75

80.00

90.00

4.25

90.00

100.00

4.75

100.00

110.00

5.25

110.00

120.00

5.75

120.00

130.00

6.25

130.00

140.00

6.75

140.00

150.00

7.25

150.00

160.00

7.75

160.00

170.00

8.25

170.00

180.00

8.75

180.00

190.00

9.25

0.50

190.00

200.00

9.75

1.00

200.00

210.00

10.25

1.50

210.00

220.00

10.75

2.00

220.00

230.00

11.25

2.50

230.00

240.00

11.75

3.00

240.00

250.00

12.25

3.50

250.00

260.00

12.75

4.00

260.00

270.00

13.25

4.50

270.00

280.00

13.75

5.00

280.00

290.00

14.25

5.50

290.00

300.00

14.75

6.00

300.00

310.00

15.25

6.50

310.00

320.00

15.75

7.00

320.00

330.00

16.25

7.50

330.00

340.00

16.75

8.00

340.00

350.00

17.25

8.50

350.00

360.00

17.75

9.00

0.25

360.00

370.00

18.25

9.50

0.75

370.00

380.00

18.75

10.00

1.25

380.00

390.00

19.25

10.50

1.75

390.00

400.00

19.75

11.00

2.25

400.00

410.00

20.25

11.50

2.75

410.00

420.00

20.75

12.00

3.25

420.00

430.00

21.25

12.50

3.75

430.00

440.00

21.75

13.00

4.25

440.00

450.00

22.25

13.50

4.75

450.00

460.00

22.75

14.00

5.25

460.00

470.00

23.25

14.50

5.75

470.00

480.00

23.75

15.00

6.25

480.00

490.00

24.25

15.50

6.75

490.00

500.00

24.75

16.00

7.25

(Effective 1/1/2013)

Booklet IL-700-T (R-12/12)

Page 19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23