Booklet Il-700-T - Illinois Withholding Tax Tables Page 3

ADVERTISEMENT

General Information

What is the purpose of this

This booklet contains Illinois Income Tax withholding tables. The tables begin on Page 5. It

booklet?

also explains how to figure the amount of Illinois Income Tax that you should withhold using

the tables in this booklet.

For answers to questions about your responsibilities as an Illinois withholding agent, see

Where do I get help?

Publication 130, Who is Required to Withhold Illinois Income Tax, and Publication 131,

Withholding Income Tax Filing and Payment Requirements. For help with other questions,

see “Where to Get Help” on Page 23 of this booklet.

How to Figure the Amount to Withhold

How much do I withhold?

Generally, the rate for withholding Illinois Income Tax is 5 percent. For wages and other

compensation, subtract any exemptions from the wages paid and multiply the result by

5 percent. For details about how much to withhold for other types of payments (i.e., Illinois

lottery or gambling winnings subject to federal income tax withholding requirements), see

Publication 130, Who is Required to Withhold Illinois Income Tax?.

How do I figure the amount

You may use the tax tables in this booklet to determine how much tax you must withhold. To

to withhold?

use the tax tables in this booklet, follow the steps below.

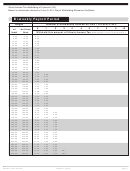

Step 1 Find the table for your payroll period (i.e., how often you pay your employee).

Using the tax tables

in this booklet

Step 2 Read down the column labeled “Wages” and locate the dollar range that contains

the amount of your employee’s wages. Read across the row until you find the dollar

amount under the number of allowances your employee claimed on Line 1 of Form

IL-W-4. If your employee did not claim any allowances on Line 2 of Form IL-W-4

and did not request that you withhold an additional amount of tax (Line 3 of Form

IL-W-4), this is the amount of tax that you must withhold.

Step 3 If your employee claimed allowances on Line 2 of Form IL-W-4, subtract the

amount identified at the top of the table from the amount found in Step 2. You must

make one subtraction for each allowance your employee claimed on Line 2 of

Form IL-W-4.

Step 4 If your employee requested that you withhold an additional amount (Line 3 of

Form IL-W-4), add that amount to the amount from Step 2 (or Step 3, if applicable).

This is the total amount of tax you must withhold.

Example

You pay Mary $300 every week. She claims three allowances on her Form IL-W-4. Two

allowances are claimed on IL-W-4, Line 1, and one allowance is claimed on Form IL-W-4,

Line 2. You withhold $10.05 from her pay.

Weekly Payroll Period

Wages

Number of allowances claimed on Line 1 of Form IL-W-4

0

1

2

3

4

5

6

7

8

9

10

at but less

(Subtract $0.96 for each allowance

least

than

Withhold this amount of Illinois Income Tax

claimed on Line 2 of Form IL-W-4.)

$300.00 302.00 15.05 13.03

11.01

8.99

6.97

4.95

2.93

0.92

302.00 304.00 15.15 13.13

11.11

9.09

7.07

5.05

3.03

1.02

304.00 306.00 15.25 13.23

11.21

9.19

7.17

5.15

3.13

1.12

306.00 308.00 15.35 13.33

11.31

9.29

7.27

5.25

3.23

1.22

Step 1 Weekly payroll table

Step 2 Locate dollar range and amount to withhold

based on allowances claimed .................................................................$ 11.01

Step 3 Subtract $0.96 for the exemption claimed on Line 2 ...............................— 0.96

Tax withheld ...........................................................................................$ 10.05

(Effective 1/1/2013)

Booklet IL-700-T (R-12/12)

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23