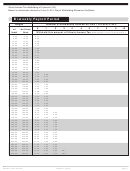

Booklet Il-700-T - Illinois Withholding Tax Tables Page 4

ADVERTISEMENT

What other method may I

If you prefer, you may use the automated payroll method to figure the amount of Illinois

use to figure the amount of

Income Tax you should withhold.

tax that I should withhold?

Tax withheld =

Automated payroll method

(

)

(

)

(Line 1 allowances x $2,100) + (Line 2 allowances x $1,000)

Wages —

.05

x

number of pay periods in a year

To determine how much to withhold using the automated payroll method formula, fol-

low these steps:

Step 1 Determine the wages paid.

Step 2 Figure your employee’s exemptions using the allowances claimed on Form IL-W-4.

Number of pay

a Multiply the number of allowances your employee claimed on Form IL-W-4,

periods in a year

Line 1, by $2,100.

b Multiply the number of allowances your employee claimed on Form IL-W-4,

Weekly payroll

52

Line 2, by $1,000.

Bi-weekly payroll

26

Semi-monthly payroll 24

c Add your answers from Step 2a and Step 2b.

Monthly payroll

12

d Divide the result of Step 2c by the number of pay periods from the table. The

Bi-monthly payroll

6

result is your employee’s exemptions.

Quarterly payroll

4

Step 3 Subtract the exemptions from the wages paid. The result is the taxable amount.

Semi-annual payroll

2

Annual payroll

1

Step 4 Multiply the taxable amount by 5 percent (.05). You must withhold this amount.

Step 5 Add any additional amount from Form IL-W-4, Line 3. This is the total amount you

withhold.

The example below illustrates how to figure the amount to withhold using the automated

payroll method.

Automated payroll

Example

method example

You pay Alice $800 every week. She claims four allowances on her Form IL-W-4. Two

allowances are claimed on Form IL-W-4, Line 1, and two allowances are claimed on

Form IL-W-4, Line 2. You withhold $34.13 from her pay.

Step 1 Determine the wages paid

$ 800.00

Step 2 Figure your employee’s exemptions

(based on Form IL-W-4).

a 2 x $2,100

= $4,200 (Line 1 x $2,100)

b 2 x $1,000

= $2,000 (Line 2 x $1,000)

c $4,200 + $2,000 = $6,200 (Step 2a + Step 2b)

d $6,200 ÷ 52 pay periods = $119.23

Step 3 Subtract the amount exempt from withholding.

— 119.23

Taxable amount

$ 680.77

Step 4 Multiply by the tax rate

x

.05

Tax withheld

$

34.04

(Effective 1/1/2013)

Page 4

Booklet IL-700-T (R-12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23