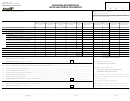

AZ FORM 815

Instructions

GENERAL INSTRUCTIONS:

“Vinous Liquor” means any liquid containing more than

one-half of 1% alcohol by volume made by the process

You must f le this return and pay the luxury tax if you

of fermentation of grapes, berries, fruits, vegetables, or

are a wholesaler of spirituous or vinous liquor selling

other substances, but not including those liquids in which

spirituous or vinous liquor within the state of Arizona.

hops or grains are used in the process of fermentation

You must also f le this return and pay the tax if you are

and not including liquids made by the process of

a wholesaler of malt liquors purchasing malt liquors for

distillation of such substances.

resale within the State.

“Malt Liquor” means any liquid containing more than

You must f le this return monthly and pay the tax on or

one-half of 1% alcohol by volume and is made by the

before the 20

day after the month the tax accrues.

th

process of fermentation and not distillation of hops or

grains but not including liquids made by the process of

Prepare this return for each month regardless of whether

distillation of such substances.

or not any tax is due. File the original with the Arizona

Department of Revenue. Retain a copy of the form with

all substantiating documentation for at least four years,

SPECIFIC INSTRUCTIONS:

subject to inspection by the Department.

Line 1: For spirits and vinous, enter the ending

inventory amount from line 7 of the previous month’s

Report all alcoholic beverages in wine gallons. Round

report. If the f gures are not equal, attach an explanation

to the nearest one-hundredth of a gallon. For spirits and

for the differences.

vinous liquors, use the Conversion Chart on page 6 to

convert from metric to gallons.

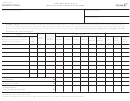

Line 2a: Prepare a separate Schedule A for each type

of beverage. On

Schedule

A, enter all beverages you

You must provide your taxpayer identif cation number

have received or purchased this month. Enter the total

on the return. A taxpayer identif cation number is either

from Schedule A on line 2a. Attach the schedule to the

your Federal Employer Identif cation Number (EIN) or

return. You may substitute a computer-generated list

your Social Security Number (SSN), if you are a sole

for the actual schedule. Attach copies of invoices for all

proprietor with no employees.

entries on Schedules.

The Licensee or Authorized Agent must sign the return.

NOTE: If you list any purchases from Arizona

wholesalers of malt as deductions on Schedule D, you

If you pay a preparer to complete this return, the

must list those purchases on Schedule A and ref ect

preparer must sign the return and include his or her

those purchases in the total on line 2a.

identif cation number.

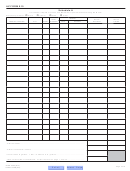

Line 2b: Enter any spirits or vinous returned by your

Send payment with the return to the Arizona Department

retailers during the month on line 2b and on line 4h. If

of Revenue. Include your taxpayer identif cation number

the f gures are not equal, attach an explanation for the

on your check.

differences.

State law imposes a penalty plus interest on the amount

Line 3: Enter the total of lines 2a and 2b.

of tax due on each return if your payment is late. State

law imposes a 5% penalty per month if you fail to f le.

Line 4a: On

Schedule

B, enter any tax-free sales to the

The combined penalties, however, cannot exceed 25%.

military during the month. Attach the schedule to the

return. You may substitute a computer-generated list for

DEFINITIONS

the actual schedule.

“Cider” means vinous liquor that is made from the

Line 4b: On

Schedule

C, enter any beverage sold out

normal alcoholic fermentation of the juice of sound, ripe

of state during the month. Attach the schedule to the

apples, including f avored, sparkling and carbonated

return. You may substitute a computer-generated list for

cider and cider made from condensed apple must, that

the actual schedule.

contains more than one-half of 1% of alcohol by volume

but not more than 7% of alcohol by volume.

“Spirituous Liquor” means any liquid containing more

than one-half of 1% alcohol by volume that is produced

by distillation of any fermented substance and is used or

prepared for use as a beverage.

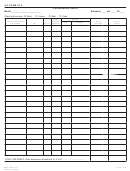

Continued on page 6

Page 5 of 6

ADOR 11080 (9/13)

Previous 14-2048 (2/07)

1

1 2

2 3

3 4

4 5

5 6

6