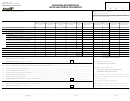

AZ FORM 815

Instructions

Line 4c: For spirits and vinous, enter on

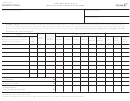

Schedule D

Line 5: Add lines 4a through 4h. Enter the total.

all spirits and vinous sold to other licensed Arizona

wholesalers during the month. Enter spirits and vinous

LIne 6: List any adjustments for the prior month and

transferred between licensed locations owned by the

attach a written explanation.

same company. Attach documentation for verif cation.

Attach the schedule to the return. You may substitute a

Line 7: For spirits and vinous, enter your month’s

computer-generated list for the actual schedule.

ending inventory from your company records.

Line 4d: For malt/cider, enter on Schedule D all

Line 8: For spirits and vinous, add lines 1 and 3.

purchases of malt/cider from other licensed Arizona

Subtract lines 5 and 7, and adjust for line 6. Enter these

wholesalers during the month. Enter malt/cider

amounts in column (a). For malt/cider, subtract line 5

transferred between licensed locations owned by the

from line 2a, and adjust for line 6. Enter these amounts

same company. Attach documentation for verif cation.

in column (b) or (c).

Attach the schedule to the return. You may substitute a

computer-generated list for the actual schedule.

Line 9: Tax rates for spirits, vinous with an alcohol

content of 24% or less by volume, and malt/cider are

NOTE: You cannot list any malt as a deduction on this

preprinted on the form. Contact the Luxury Tax Section

schedule unless you listed them on Schedule A and

of the Arizona Department of Revenue for the rate on

included them in the total on line 2a.

any vinous with an alcohol content of more than 24% by

volume, containing eight (8) ounces or less and for each

Line 4e: Enter any beverage that you destroyed during

eight (8) ounces for containers containing more than

the month.

eight (8) ounces.

Line 4f: Enter any beverage that broke during the

Line 10: For each column (a), (b), and (c), multiply the

month.

number of gallons entered on line 8 by the rate on line 9.

Enter the amount for each column.

Line 4g: Enter any beverage that you returned to your

suppliers during the month.

Line 11: Add the amounts in columns (a), (b), and (c) of

line 10. Enter this amount as the Total Tax Due.

Line 4h: See the instructions for line 2b for explanation.

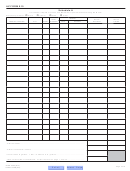

CONVERSION CHART

Bottles

U.S. Gallons

Liquor Type

Bottle Size

Per Case

Per Case

SPIRITUOUS:

1.75 liter

6

2.7738

1.00 liter

12

3.1701

750 milliliters

12

2.3775

500 milliliters

24

3.1701

200 milliliters

48

2.5361

50 milliliters

120

1.5850

VINOUS:

3.00 liter

4

3.1701

1.50 liter

6

2.3775

1.00 liter

12

3.1701

750 milliliters

12

2.3775

375 milliliters

24

2.3775

187 milliliters

48

2.3712

100 milliliters

60

1.5850

Off cial Conversion Factor: 1 liter = 0.264172 U.S. gallons

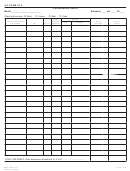

Page 6 of 6

ADOR 11080 (9/13)

Previous 14-2048 (2/07)

1

1 2

2 3

3 4

4 5

5 6

6