Form Rv-F1302501 - Aplication For States Sales And Use Tax Exemption For Qualified Materials Handling Equipment And Packing System

ADVERTISEMENT

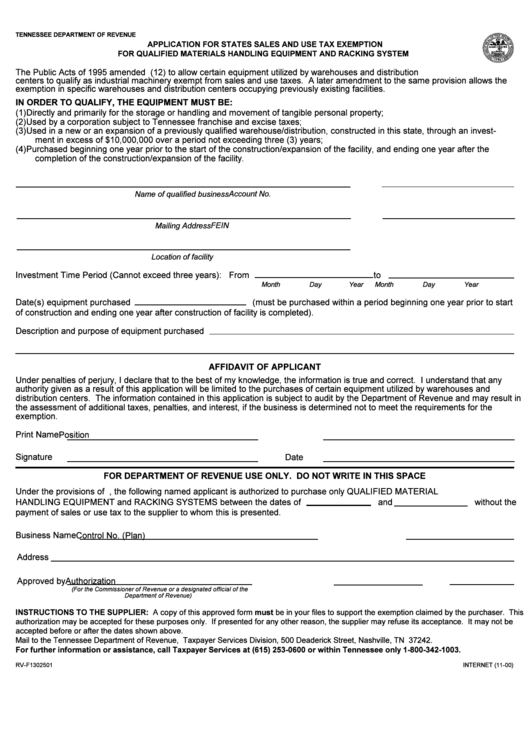

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR STATES SALES AND USE TAX EXEMPTION

FOR QUALIFIED MATERIALS HANDLING EQUIPMENT AND RACKING SYSTEM

The Public Acts of 1995 amended T.C.A. Section 67-6-102(12) to allow certain equipment utilized by warehouses and distribution

centers to qualify as industrial machinery exempt from sales and use taxes. A later amendment to the same provision allows the

exemption in specific warehouses and distribution centers occupying previously existing facilities.

IN ORDER TO QUALIFY, THE EQUIPMENT MUST BE:

(1) Directly and primarily for the storage or handling and movement of tangible personal property;

(2) Used by a corporation subject to Tennessee franchise and excise taxes;

(3) Used in a new or an expansion of a previously qualified warehouse/distribution, constructed in this state, through an invest-

ment in excess of $10,000,000 over a period not exceeding three (3) years;

(4) Purchased beginning one year prior to the start of the construction/expansion of the facility, and ending one year after the

completion of the construction/expansion of the facility.

Name of qualified business

Account No.

FEIN

Mailing Address

Location of facility

Investment Time Period (Cannot exceed three years): From

to

Month

Day

Year

Month

Day

Year

Date(s) equipment purchased

(must be purchased within a period beginning one year prior to start

of construction and ending one year after construction of facility is completed).

Description and purpose of equipment purchased

AFFIDAVIT OF APPLICANT

Under penalties of perjury, I declare that to the best of my knowledge, the information is true and correct. I understand that any

authority given as a result of this application will be limited to the purchases of certain equipment utilized by warehouses and

distribution centers. The information contained in this application is subject to audit by the Department of Revenue and may result in

the assessment of additional taxes, penalties, and interest, if the business is determined not to meet the requirements for the

exemption.

Print Name

Position

Signature

Date

FOR DEPARTMENT OF REVENUE USE ONLY. DO NOT WRITE IN THIS SPACE

Under the provisions of T.C.A. Sec. 67-6-102, the following named applicant is authorized to purchase only QUALIFIED MATERIAL

HANDLING EQUIPMENT and RACKING SYSTEMS between the dates of

and

without the

payment of sales or use tax to the supplier to whom this is presented.

Business Name

Control No. (Plan)

Address

Approved by

Authorization No.

Date

(For the Commissioner of Revenue or a designated official of the

Department of Revenue)

INSTRUCTIONS TO THE SUPPLIER: A copy of this approved form must be in your files to support the exemption claimed by the purchaser. This

authorization may be accepted for these purposes only. If presented for any other reason, the supplier may refuse its acceptance. It may not be

accepted before or after the dates shown above.

Mail to the Tennessee Department of Revenue, Taxpayer Services Division, 500 Deaderick Street, Nashville, TN 37242.

For further information or assistance, call Taxpayer Services at (615) 253-0600 or within Tennessee only 1-800-342-1003.

RV-F1302501

INTERNET (11-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2