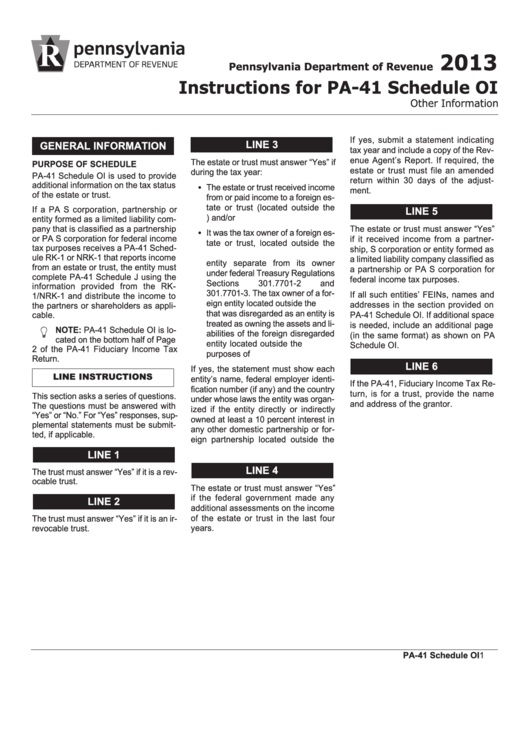

Instructions For The Pa-41 Schedule Oi - Other Information - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule OI

Other Information

If yes, submit a statement indicating

LINE 3

GENERAL INFORMATION

tax year and include a copy of the Rev-

enue Agent’s Report. If required, the

The estate or trust must answer “Yes” if

PURPOSE OF SCHEDULE

estate or trust must file an amended

during the tax year:

PA-41 Schedule OI is used to provide

return within 30 days of the adjust-

additional information on the tax status

•

The estate or trust received income

ment.

of the estate or trust.

from or paid income to a foreign es-

tate or trust (located outside the

If a PA S corporation, partnership or

LINE 5

U.S.) and/or

entity formed as a limited liability com-

pany that is classified as a partnership

The estate or trust must answer “Yes”

•

It was the tax owner of a foreign es-

or PA S corporation for federal income

if it received income from a partner-

tate or trust, located outside the

tax purposes receives a PA-41 Sched-

ship, S corporation or entity formed as

U.S. that was disregarded as an

ule RK-1 or NRK-1 that reports income

a limited liability company classified as

entity separate from its owner

from an estate or trust, the entity must

a partnership or PA S corporation for

under federal Treasury Regulations

complete PA-41 Schedule J using the

federal income tax purposes.

Sections

301.7701-2

and

information provided from the RK-

301.7701-3. The tax owner of a for-

If all such entities’ FEINs, names and

1/NRK-1 and distribute the income to

eign entity located outside the U.S.

addresses in the section provided on

the partners or shareholders as appli-

that was disregarded as an entity is

PA-41 Schedule OI. If additional space

cable.

treated as owning the assets and li-

is needed, include an additional page

NOTE: PA-41 Schedule OI is lo-

abilities of the foreign disregarded

(in the same format) as shown on PA

cated on the bottom half of Page

entity located outside the U.S. for

Schedule OI.

2 of the PA-41 Fiduciary Income Tax

purposes of U.S. income tax law.

Return.

LINE 6

If yes, the statement must show each

LINE INSTRUCTIONS

entity’s name, federal employer identi-

If the PA-41, Fiduciary Income Tax Re-

fication number (if any) and the country

turn, is for a trust, provide the name

This section asks a series of questions.

under whose laws the entity was organ-

and address of the grantor.

The questions must be answered with

ized if the entity directly or indirectly

“Yes” or “No.” For “Yes” responses, sup-

owned at least a 10 percent interest in

plemental statements must be submit-

any other domestic partnership or for-

ted, if applicable.

eign partnership located outside the

U.S.

LINE 1

LINE 4

The trust must answer “Yes” if it is a rev-

ocable trust.

The estate or trust must answer “Yes”

if the federal government made any

LINE 2

additional assessments on the income

of the estate or trust in the last four

The trust must answer “Yes” if it is an ir-

years.

revocable trust.

PA-41 Schedule OI

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1