be considered qualified property for purposes of the tax credit.

property purchased for use in an eligible research and development

project, plus the amount of qualified research expenses deducted by

INELIGIBLE PROPERTY

the taxpayer for federal income tax purposes.

Property purchased for research and development shall not include

Property Investment

the following:

To determine the amount of property investment eligible for the

1. Land and improvements thereto;

Strategic Research and Development Tax Credit, the net cost of

each property purchased is multiplied by the applicable percentage

2. Repair costs, including materials used in making the repair;

shown below according to the useful life of the property. In order

3. Motor vehicles licensed by the Department of Motor

to be eligible for the credit, the property must have been placed

Vehicles;

into use in West Virginia during the taxable year.

4. Airplanes;

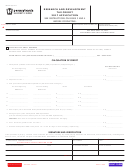

If useful life is:

The applicable percentage is:

5. Property located or primarily used outside this State;

Less than 4 years

33⅓ %

6. Property acquired incident to the purchase of the stock or

assets of an industrial taxpayer which was or had been used

4 years or more but less than 6 years

66⅔ %

by the seller in its industrial business in this State, or which

6 years or more

100 %

was previously designated property purchased for either

the business investment and jobs expansion credit or the

EXAMPLE

economic opportunity tax credit, property purchased for

If a taxpayer purchases $30,000 of machinery with a useful life of

either the industrial expansion and revitalization credit or

four years for use in an eligible research and development project,

the manufacturing investment tax credit, property purchased

the eligible investment is equal to $20,000. The eligible investment

for the research and development project credit, or property

is calculated by multiplying the cost of machinery, $30,000 times

purchased for the coal-loading facility credit.

the applicable percentage according to the useful life, 66 ⅔%, to

7. Property purchased or placed into service prior to January

arrive at $20,000.

1, 2003.

QUALIFIED RESEARCH EXPENSES

NET COST

Qualified research expenses means the sum of in-house and

Net cost is the net monetary consideration provided for acquisition

contract research expenses paid or incurred for qualified research

of title and/or ownership to the subject property. Net cost shall

allocated to West Virginia by an eligible taxpayer. Qualified research

not include the value of any property given in trade or exchange

expenses do not include any expense that must be capitalized and

for property purchased for an eligible research and development

depreciated for federal income tax purposes, or any expenditure

project. If property is damaged or destroyed by fire, flood, storm or

paid or incurred for the purpose of ascertaining the existence,

other casualty or is stolen, the cost of replacement shall not include

location, extent or quality of any deposit of coal, limestone, or other

any insurance proceeds received in compensation for the loss.

natural resource, including oil or gas.

In the case of leased property, net cost is the rent reserved for the

In-House Research Expenses

primary term of the lease, not to exceed 20 years.

In-house research expenses include:

In the case of self-constructed property, the cost thereof is the

amount of property charged to the capital account for purposes of

A. Wages paid or incurred to an employee for qualified services

depreciation.

performed in this State by such employee;

B. Amounts paid or incurred for supplies used in the conduct

PROPERTY PURCHASED FOR

of qualified research in this State; and

MULTIPLE BUSINESS USE

C. Amounts paid or incurred to another person for the right

If property is purchased for multiple business use, including use as

to use personal property in the conduct of qualified research

a component part of an eligible research and development project

in this State.

together with some other business or occupation not qualifying (for

Qualified services include services consisting of:

example, retailing), the cost of the property must be apportioned.

The apportionment of multiple-use properties must be thoroughly

A. Engaging in qualified research in this State; or

supported and explained by separate documents submitted with

the application.

B. Engaging in the direct supervision or direct support of

research activities in this State, which constitute qualified

ELIGIBLE INVESTMENT

research.

If substantially all of the services performed by an individual for

The eligible investment in a research and development project is

the taxpayer during the taxable year consist of services meeting

the sum of the applicable percentage of the cost of depreciable

2

2

t

t

Rev. 9/12

Rev. 9/12

1

1 2

2 3

3 4

4 5

5 6

6