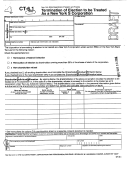

Form Rev-1640 Ct - General Instructions Election To Be Taxed As A Pennsylvania "S" Corporation Page 2

ADVERTISEMENT

REV-1640 CT (6-99) (I)

Please complete the REV-1640 in duplicate.

A copy of the REV-1640 will be returned upon approval.

A

newly

formed

corporation

may

elect

Subchapter S subsidiary shall be effective for

Pennsylvania S Corporation tax treatment for its

the qualified Subchapter S subsidiary. A qualified

first taxable year in Pennsylvania by filing a

Subchapter S subsidiary is not required to file a

Pennsylvania S Corporation election within 75

separate Pennsylvania S Corporation election.

days of incorporation or date of first activity.

A qualified Subchapter S subsidiary is not eligi-

A foreign corporation may elect Pennsylvania S

ble to elect Pennsylvania S Corporation tax

Corporation tax treatment for its first taxable

treatment independent of its parent Federal S

year in Pennsylvania by filing a Pennsylvania S

Corporation. A qualified Subchapter S subsidiary

Corporation election with the Department within

of a Federal S Corporation that does not have a

75 days of the start of its first taxable year in

valid Pennsylvania S Corporation election in

Pennsylvania. A foreign corporation’s first tax-

effect

shall

not

receive

Pennsylvania

S

able year in Pennsylvania commences on the

Corporation tax treatment.

date the corporation begins doing business in

Pennsylvania and becomes subject to the corpo-

rate net income tax.

ACKNOWLEDGMENT OF RECEIPT

A corporation which has filed a Federal S

OF ELECTION

Corporation election, but has not yet received

approval, may still file the Pennsylvania S

Within approximately ninety (90) days from the

Corporation election, indicating that federal

receipt of this election, the Department of

approval is pending, and shall submit a copy of

Revenue will issue a confirmation of approval

granting Pennsylvania S status. The confirmation

the federal approval to the Department within 30

will be mailed to the taxpayer. If the confirmation

days of receipt.

is not received within this time, the taxpayer

should call the Bureau of Corporation Taxes at

The Pennsylvania S Corporation election must

(717) 787-8353 to verify if the election was

be submitted to:

received. It is the exclusive responsibility of the

PA Department of Revenue

taxpayer to provide timely proof of mailing, a cer-

Bureau of Corporation Taxes

tified mail receipt.

PA “S” UNIT

Dept. 280705

Harrisburg, PA 17128-0705

Pennsylvania

S

Corporation

Tax

Report

Instructions provide further explanations for the

taxation of Pennsylvania S Corporations and their

shareholders.

QUALIFIED SUBCHAPTER S

SUBSIDIARIES

When filing the first tax report that S status is

A Pennsylvania S Corporation election filed by

effective, include a copy of the Pennsylvania and

the parent Federal S Corporation of a qualified

federal notice of acceptance letters.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2