Controlling Interest Transfer Tax

A new tax was enacted in July, 2006 imposing a transfer tax of 1% on certain transfers of controlling interest

in entities possessing commercial real property. Specifically, if a controlling interest in an entity which possesses,

directly or indirectly, a controlling interest in classified real property, then, with certain exceptions mentioned below,

the purchaser of the controlling interest must pay a tax. The tax was established by P.L. 2006, c. 33, Section 3,

(N.J.S.A. 54:15C-1), approved July 8, 2006.

The real property that is the subject of this tax statute is class 4A “commercial property” that is any kind of

income-producing real property other than property classified as vacant land, residential property, farm property,

industrial properties, and apartments.

The sale or transfer of a controlling interest subject to taxation may occur in one transaction or in a series of

transactions. Transactions which occur within six months of each other are presumed, unless shown to the contrary,

to be a series of transactions constituting a single sale or transfer.

A sale or transfer subject to tax may be accomplished by one purchaser or may be made by a group of

purchasers acting in concert. Purchasers that are related parties are presumed to be acting in concert, unless the

contrary is established to the satisfaction of the Director.

The act has transitional provisions. The act applies to transfers of controlling interests in property on and

after August 1, 2006, except that if the transfer of a controlling interest is made on or before November 15, 2006

pursuant to a contract or other binding agreement that was fully executed before July 1, 2006, no tax shall apply.

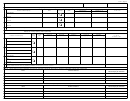

Calculation of the Tax

The statute provides two different methods for calculating the tax that must be used under different

circumstances. The first method is used if consideration in excess of $1,000,000 is paid for controlling interest and

the entity owning the classified real property owns only the classified real property.

The second method is used if the entity owns classified real property and also an interest in other property,

real or personal. In this second method the equalized assessed value of the classified property, not the amount of

consideration paid for the controlling interest, is relevant to the calculation of tax. In this situation, a tax shall be paid

on the sale or transfer only if the equalized assessed value of the classified real property exceeds $1,000,000, which

shall be paid by the purchaser. The tax is measured by the portion of the equalized assessed value that is

proportional to the percentage of the total interest in the property transferred.

Filing and Record Keeping

On or before the last day of the month following the month when the sale or transfer of a controlling interest

was completed, the purchaser/transferee must file a return with the Director, Division of Taxation. Payment of the tax

shall accompany the return. A copy of the return shall accompany the purchaser/transferee’s business tax return filed

with New Jersey.

Purchaser/transferee shall supply a copy of the CITT-1 to the seller/transferor and a copy of such return

shall be attached as an exhibit to the seller/transferor’s business tax return for the entity filed with New Jersey.

If sale or transfer of a controlling interest in an entity occurs, the entity shall keep a record of every transfer

of a controlling interest in its stock or in its capital, profits, or beneficial interests as the case may be.

When an exemption box is checked on form CITT-1, Part 6 or Part 7, attach a properly executed CITT-1E

“Statement of Waiver” to Form CITT-1 and file both forms. The completed CITT-1E documents why no tax is paid.

Calculations must be shown on Part 6 and/or Part 7 of the CITT-1 even if an exemption is claimed.

Administration of the controlling interest transfer tax is governed by The State Uniform Tax Procedure Law.

___________________________________________________________________________________

1

1 2

2 3

3 4

4 5

5 6

6