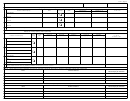

Controlling Interest Transfers Tax

–

Return Instructions

Part 1:

1.

Enter the name and address of the seller.

2.

Enter the SSN or Business ID number of the seller.

3.

Enter the New Jersey Business number (if any) of the seller.

4.

If there is more than one seller, this information must be completed for each seller.

Part 2:

1.

Enter the name and address of the purchaser.

2.

Enter the SSN or Business ID number of the purchaser.

3.

Enter the New Jersey Business number (if any) of the purchaser.

4.

If there is more than one seller, this information must be completed for each purchaser.

Part 3:

1.

Enter the name and address of the entity in which controlling interest was transferred.

2.

Enter the Federal ID number of the transferred entity.

3.

Enter the New Jersey Registration number (if any) of the transferred entity.

4.

Check the type of entity transferred.

Part 4:

1.

Enter the Business Property Identification and Location. If more than one property is involved, attach a rider

to continue Part 4.

Part 5:

1.

Enter the amount of tax calculated from the sale of Business Class 4A – Real Property from Part 6, line 4.

(if none, enter zero)

2.

Enter the amount of tax calculated from the transfer of a Controlling Interest in an entity that owns qualified

Class 4A – Real Property from Part 7, line 4. (if none, enter zero)

3.

Add lines 1 & 2.

4.

Calculate any applicable interest due.

5.

Calculate any applicable penalty due.

6.

Add lines 3, 4, & 5 for Total amount due.

Part 6:

1.

Enter street address and town of real property.

2.

Check box if exempt. Exemptions include the following sales or transfers:

a.

By or to the United States of America, the State of New Jersey, or any instrumentality, agency or

subdivision thereof;

b.

To a purchaser that is recognized as qualified under IRC 501(c)3;

c.

Having the characteristics listed in N.J.S.A. 46:15-10, which concerns deeds excluded from

additional recording fee, or that is subject to the fee imposed by N.J.S.A. 46:15-7.2 concerning the

fee for the transfer of real property:

•

that is classified pursuant to the requirements of N.J.A.C. 18:12-2.2 as Class 2 “residential”;

•

that includes property classified pursuant to the requirements of N.J.A.C. 18:12-2.2 as class

3A: “farm property (regular)” but only if the property includes a building or structure intended or

suited for residential use, and any other real property, regardless of class, that is effectively

transferred to the same grantee in conjunction with the class 3A property;

•

that is a cooperative unit as defined in section 3 of P.L. 1987, c.381 (C.46:8D-3); or

1

1 2

2 3

3 4

4 5

5 6

6